Best Strategies for Day Traders to Buy in February 2026

Trading: Technical Analysis Masterclass: Master the financial markets

- MASTER TECHNICAL ANALYSIS TO NAVIGATE FINANCIAL MARKETS CONFIDENTLY.

- UNLOCK EXPERT STRATEGIES WITH PREMIUM QUALITY INSIGHTS AND GUIDANCE.

- ELEVATE YOUR TRADING SKILLS WITH COMPREHENSIVE, EASY-TO-FOLLOW LESSONS.

Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude

- IDEAL PICK FOR AVID READERS SEEKING ENGAGING CONTENT.

- PERFECT GIFT FOR BOOK LOVERS AND LITERARY ENTHUSIASTS.

- ELEVATE READING EXPERIENCES WITH QUALITY INSIGHTS AND STORIES.

How to Day Trade for a Living: A Beginner’s Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing)

- FLEXIBILITY: WORK FROM ANYWHERE, ANYTIME, ON YOUR OWN TERMS!

- ACHIEVE INDEPENDENCE: BE YOUR OWN BOSS AND SET YOUR OWN SCHEDULE!

- SUCCESS REQUIRES TOOLS: EQUIP YOURSELF FOR EFFECTIVE DAY TRADING!

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

- PERFECT GIFT FOR ANY BOOK LOVER!

- COMPACT DESIGN, GREAT FOR ON-THE-GO READING.

- THOUGHTFUL GIFT CHOICE FOR AVID READERS!

Best Loser Wins: Why Normal Thinking Never Wins the Trading Game – written by a high-stake day trader

How to Day Trade: The Plain Truth

The Trader's Handbook: Winning habits and routines of successful traders

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.blogweb.me/1/41e_Ap_i_Cp_LL_SL_160_77e9e088f0.jpg)

The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.blogweb.me/1/51_Jozc_NDI_6_L_SL_160_1c2c477e32.jpg)

The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

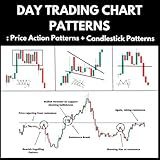

Day Trading Chart Patterns : Price Action Patterns + Candlestick Patterns

Day traders can avoid good faith violations by closely monitoring their accounts and making sure they have enough settled funds available to cover their trades. They need to adhere to the rules and regulations set by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC).

To avoid good faith violations, day traders should be aware of the settlement period for their trades. The settlement period is typically two business days for stocks and one business day for options. Therefore, traders must ensure that they have sufficient settled funds in their account before placing any new trades.

Day traders can avoid good faith violations by using a cash account rather than a margin account. Cash accounts only allow traders to use the settled funds available in their account for trading, thereby eliminating the risk of good faith violations.

Another strategy to avoid good faith violations is to use a brokerage that offers instant settlement. This allows day traders to use the proceeds from a sale immediately without having to wait for the settlement period to complete.

Keeping a close eye on their account activity is crucial for day traders. They should regularly review their buying power and monitor their unsettled funds to avoid any potential violations. By carefully managing their trades and funds, day traders can significantly reduce the risk of good faith violations.

What are the limitations imposed by the Financial Industry Regulatory Authority (FINRA) regarding good faith violations?

The Financial Industry Regulatory Authority (FINRA) imposes limitations on good faith violations to prevent excessive trading and to ensure investor protection. These limitations revolve around the concept of free-riding and are as follows:

- Three Strikes Rule: If an account commits three good faith violations in a 12-month period, the account will be restricted from trading for 90 days. During this time, the account can only make trades using settled funds.

- Cash Account Restrictions: If a customer buys a security using unsettled funds in a cash account and then sells the security before the funds are fully settled, it will be considered a good faith violation. The customer will be restricted from purchasing securities for 90 days using unsettled funds.

- Pattern Day Trader Rule: According to this rule, a customer who executes four or more day trades within five business days in a margin account is classified as a pattern day trader. Pattern day traders are required to maintain a minimum account balance of $25,000, and if the balance falls below this threshold, restrictions will be imposed.

These limitations are designed to deter improper trading practices and discourage speculative behavior that can potentially harm investors.

What precautions should day traders take during market opening and closing hours to prevent good faith violations?

Day traders should take the following precautions during market opening and closing hours to prevent good faith violations:

- Understand the rules: Familiarize yourself with the regulations and rules regarding good faith violations set by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). This will help you understand the limitations and requirements for avoiding good faith violations.

- Maintain sufficient account equity: Ensure that you have enough funds or buying power in your account to cover any purchases you make during market opening and closing hours. This can help prevent a violation when buying stocks with unsettled funds.

- Be aware of settlement periods: Understand the settlement periods for cash accounts and margin accounts, as they vary. Cash accounts typically have a trade settlement period of T+2 (trade date plus two business days), while margin accounts have a shorter settlement period of T+1. Plan your trades accordingly to avoid purchasing stocks with unsettled funds.

- Monitor your account activity: Regularly check your account balance, available buying power, and unsettled funds throughout the trading day, especially during market opening and closing hours. This will help you stay aware of your account status and prevent accidental violations.

- Avoid frequent buying and selling: Engaging in excessive buying and selling of securities, especially within short time frames, increases the likelihood of triggering good faith violations. Stick to a well-thought-out trading strategy, focusing on quality trades rather than excessive trading volume.

- Utilize a cash account: Consider using a cash account rather than a margin account if you are prone to good faith violations. Cash accounts do not have the same restrictions on trading with unsettled funds, but they have limitations on instant settlement and borrowing power.

- Be cautious with margin trading: If you trade on margin, be mindful of your borrowing capacity and understand the risks involved. Margin accounts provide leverage, which can help amplify returns but also increase potential losses. Being prudent with margin usage can help prevent good faith violations.

- Consult with your broker: If you have any doubts or questions about good faith violations or account requirements, consult with your broker or brokerage firm. They can provide specific guidance based on your account type and circumstances.

Remember, it is crucial to maintain a thorough understanding of the regulations and rules surrounding good faith violations, as non-compliance can result in trading restrictions or penalties.

What is the role of unsettled funds in avoiding good faith violations?

Unsettled funds play a crucial role in avoiding good faith violations when trading stocks or other securities. A good faith violation occurs when an investor purchases securities using unsettled funds and sells those securities before the funds used for the initial purchase have settled.

Settlement refers to the process of finalizing a transaction, transferring the ownership of securities, and exchanging payment between the buyer and the seller. This process typically takes two business days in the United States, known as the T+2 settlement period.

To understand the role of unsettled funds, let's consider an example:

- Day 1: An investor has $5,000 in their account and decides to buy XYZ stock. They place a buy order for $5,000 worth of XYZ shares. At this point, the investor has made a commitment to purchase the shares, but the funds have not settled yet.

- Day 2: The investor's buy order is executed, and they now have a position in XYZ stock. However, the $5,000 used to make this purchase is still in the process of settlement.

- Day 3: The investor, who now owns XYZ shares, decides to sell them without waiting for the initial funds to settle. This is where a good faith violation occurs as the investor has sold shares that were purchased using unsettled funds.

To avoid such violations, it is important to wait for funds from the sale of a security to settle before using them to make another purchase. In the example above, the investor should wait until Day 4 (the second business day after the sale) to use the proceeds from the sale of XYZ shares to make a new purchase.

In summary, unsettled funds must be allowed to settle before they can be used again for trading or investing. This settlement period helps ensure that investors have sufficient funds in their accounts to cover transactions, avoid overdrawing their accounts, and prevent good faith violations.

How to recognize signs of potential good faith violations?

Recognizing signs of potential good faith violations can be challenging, but there are a few indicators that can help identify such behavior. Here are some ways to recognize these signs:

- Inconsistent behavior: Look for inconsistent actions or statements from the person that may contradict their previous behavior or claims. Discrepancies in their behavior could indicate a potential violation of good faith.

- Lack of transparency: If someone avoids providing relevant information or is reluctant to share details about their actions or intentions, it may suggest that they are not acting in good faith. Lack of transparency can indicate hidden motives or misleading intentions.

- Unreasonable demands or practices: Pay attention to any requests, demands, or practices that seem unreasonable, excessive, or unfair. An individual acting in good faith will generally exhibit fair and reasonable behavior.

- Failure to disclose conflicts of interest: When someone fails to disclose relevant conflicts of interest or hides information that could influence their decision-making process, it could be an indication of a potential good faith violation.

- Ignoring or dismissing opposing viewpoints: Good faith involves considering and respecting different perspectives and opinions. If someone consistently ignores or dismisses opposing viewpoints without proper consideration or justification, it might indicate a lack of good faith.

- Acting with a lack of sincerity or honesty: If someone consistently misrepresents facts, manipulates information, or shows a general lack of sincerity or honesty in their interactions, it could suggest a potential violation of good faith.

- Misusing power or authority: Pay attention to how someone uses their power or authority. If they exploit their position for personal gain, engage in nepotism, or act in ways that benefit themselves unfairly, it could indicate a violation of good faith.

It is important to note that recognizing signs of potential good faith violations requires careful observation and may not always be definitive. It is essential to gather all available information, consider context, and engage in open communication to better understand the intentions and motivations of individuals involved.

How do day traders avoid executing back-to-back transactions to prevent good faith violations?

Day traders can avoid executing back-to-back transactions to prevent good faith violations by following a few strategies:

- Utilize settled funds: Make sure to trade using settled funds in your account rather than relying on unsettled funds. Settled funds are the proceeds from the sale of securities that have already settled, typically taking two business days. Using these funds ensures that you are not repeatedly relying on unsettled funds for trading.

- Maintain sufficient cash balance: Ensure that you have enough cash available in your account to cover any purchase transactions. This way, you can avoid relying on the proceeds from a recent sale to make another purchase, preventing consecutive trades using unsettled funds.

- Track the settlement cycle: Keep track of the settlement cycle of your account to know when funds from a sale become available. This awareness will help you plan your trades accordingly, avoiding back-to-back transactions using unsettled funds.

- Use a margin account sparingly: Margin accounts allow traders to borrow money from the brokerage to make trades. However, using margin excessively or frequently can increase the risk of good faith violations. So, it's better to limit the use of margin accounts for occasional situations that require more funds.

- Work with a reputable broker: Choose a reliable and experienced broker who provides clear guidelines and warnings related to good faith violations. They can offer guidance and leverage technology to help you avoid inadvertent violations.

Remember, good faith violations occur when you buy and sell securities without having enough settled funds in your account to cover the purchase. By adhering to these strategies, day traders can minimize the chances of executing back-to-back transactions using unsettled funds and thereby avoid good faith violations.

How to calculate the net liquidating value to prevent good faith violations?

To calculate the net liquidating value in order to prevent good faith violations, follow these steps:

- Determine the account's current net liquidating value (NLV) by adding the total market value of all securities held in the account to any cash balance or available buying power.

- Identify any unsettled sales from the previous trading day that may reduce the current NLV. These unsettled sales will typically show as "unsettled funds" or "unsettled cash" on your account statement.

- Subtract the unsettled sales amount from the NLV to get the adjusted NLV.

- Check if there are any pending buy orders that have not been fully paid for using settled funds from the account. If there are any, subtract the total cost of these pending buy orders from the adjusted NLV.

- Determine if the adjusted NLV is sufficient to cover the purchase of any securities in the account without triggering a good faith violation. A good faith violation occurs when you buy a security in a cash account without enough settled funds, and then sell the same security before the cash proceeds settle. This violates the Federal Reserve Board's Regulation T and can result in trading restrictions.

- To prevent good faith violations, ensure that the adjusted NLV is equal to or greater than the total cost of any intended purchase(s) before placing the order.

Note: It's advisable to consult with your financial advisor or brokerage firm for specific guidance on calculating the net liquidating value and preventing good faith violations, as rules and requirements may differ based on the jurisdiction and brokerage firm.