Best Loan Calculators to Buy in February 2026

Calculated Industries 3405 Real Estate Master IIIx Residential Real Estate Finance Calculator | Clearly-Labeled Function Keys | Simplest Operation | Solves Payments, Amortizations, ARMs, Combos, More

-

INSTANT ANSWERS BOOST PROFESSIONALISM AND CLOSE MORE HOME SALES.

-

DEDICATED KEYS STREAMLINE FINANCING OPTIONS FOR QUICK CLIENT SOLUTIONS.

-

USER-FRIENDLY INTERFACE SIMPLIFIES MORTGAGE CALCULATIONS FOR AGENTS.

Victor 6500 Executive Desktop Loan Calculator, 12-Digit LCD

- EXTRA-LARGE 12-DIGIT DISPLAY FOR EASY VIEWING AND ACCURACY.

- LOAN WIZARD FEATURE SIMPLIFIES COMPLEX CALCULATIONS EFFORTLESSLY.

- INPUT ANY THREE LOAN VARIABLES TO EASILY FIND THE FOURTH.

Calculated Industries 43430 Qualifier Plus IIIfx Desktop PRO Real Estate Mortgage Finance Calculator | Clearly-Labeled Keys | Buyer Pre-Qualifying | Payments, Amortizations, ARMs, Combos, FHA/VA, More

-

SIMPLIFY MORTGAGE TERMS FOR CLIENTS WITH CLEAR, LABELED KEYS.

-

BOOST PROFESSIONALISM AND CLOSE MORE SALES WITH FAST SOLUTIONS.

-

EASILY PRE-QUALIFY BUYERS WITH DEDICATED INCOME AND EXPENSE KEYS.

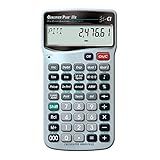

Calculated Industries 3430 Qualifier Plus IIIfx Advanced Real Estate Mortgage Finance Calculator | Clearly-Labeled Keys | Buyer Pre-Qualifying | Payments, Amortizations, ARMs, Combos, FHA/VA, More

-

SIMPLIFIED KEY TERMS FOR EASY CLIENT COMMUNICATION SPEAK YOUR CLIENT'S LANGUAGE WITH MORTGAGE FINANCE TERMINOLOGY.

-

INSTANT BUYER PRE-QUALIFICATION FOR SMART PROPERTY CHOICES QUALIFY BUYERS ON-THE-SPOT TO SHOW ONLY AFFORDABLE PROPERTIES.

-

QUICK LOAN COMPARISONS FOR TAILORED CLIENT SOLUTIONS EFFORTLESSLY EXPLORE LOAN OPTIONS AND PAYMENT SOLUTIONS WITH EASE.

Calculated Industries 3400 Pocket Real Estate Master Financial Calculator

- CALCULATE LOAN PAYMENTS INSTANTLY FOR BETTER FINANCIAL PLANNING.

- TRACK REMAINING BALANCES EFFORTLESSLY WITH ACCURATE FORECASTS.

- UTILIZE DATE MATH FOR FLEXIBLE PAYMENT SCHEDULING AND MANAGEMENT.

HP 12C Financial Calculator – 120+ Functions: TVM, NPV, IRR, Amortization, Bond Calculations, Programmable Keys – RPN Desktop Calculator for Finance, Accounting & Real Estate – Includes Case + Cloth

-

PROVEN RELIABILITY: TRUST HP 12C, THE STANDARD SINCE 1981 FOR PROS.

-

VERSATILE FUNCTIONS: 120+ BUILT-IN FUNCTIONS FOR COMPREHENSIVE FINANCIAL ANALYSIS.

-

EFFICIENT RPN ENTRY: SAVE TIME WITH FAST DATA ENTRY USING REVERSE POLISH NOTATION.

Calculated Industries 3415 Qualifier Plus IIIx Advanced Real Estate Mortgage Finance Calculator | Simple Operation | Buyer Pre-Qualifying | Solves Payments, Amortization, ARMs, Combos, FHA, VA, More

- EASILY CALCULATE LOANS WITH INDUSTRY-STANDARD MORTGAGE TERMS

- BOOST CLIENT CONFIDENCE WITH FAST, ACCURATE FINANCIAL SOLUTIONS

- PRE-QUALIFY BUYERS, COMPARE OPTIONS, AND CLOSE MORE SALES

Victor 1560-6 12 Digit Heavy Duty Commercial Printing Calculator with Large Display and Loan Wizard

- LARGE DISPLAY FOR EASY READABILITY IN ANY LIGHTING CONDITIONS.

- LOAN WIZARD FEATURE SIMPLIFIES COMPLEX FINANCIAL CALCULATIONS.

- HEAVY-DUTY DESIGN ENSURES DURABILITY FOR HIGH-VOLUME USAGE.

When determining how much personal loan you can get on a $75,000 salary, several factors come into play. Lenders consider multiple aspects before approving a loan amount. Here are some factors that influence your loan eligibility:

- Debt-to-Income Ratio: One of the crucial factors lenders consider is your debt-to-income ratio. This ratio indicates the percentage of your income that goes towards debt repayment. Lenders generally prefer a lower ratio, generally around 40%.

- Credit Score: Your credit score is an essential aspect lenders evaluate. A good credit score indicates responsible financial behavior and makes you eligible for better loan terms. Higher credit scores generally result in larger loan amounts.

- Employment Stability: Lenders may also consider your employment stability. A consistent employment history and job security can increase your chances of securing a larger personal loan.

- Existing Financial Obligations: Your current financial commitments, such as rent, mortgage payments, car loans, student loans, and credit card debts, can impact your loan eligibility. Lenders generally deduct your existing obligations from your income to determine if you can afford additional debt.

- Repayment Ability: Lenders assess your ability to repay the loan. They analyze your income, monthly expenses, and savings to judge how much loan you can comfortably repay without straining your finances.

While the final loan amount varies depending on these factors, in general, with a $75,000 salary, you could potentially qualify for personal loans ranging from a few thousand dollars to around $50,000 or more. However, it is important to note that loan eligibility and terms differ among lenders. It is advisable to research and compare various lenders to find the one that offers the best loan options based on your specific financial situation.