Best Financial Tools for Single Mothers to Buy in February 2026

One Hen: How One Small Loan Made a Big Difference (CitizenKid, 5)

Small Business Loans Made Simple: Revealing Insider Secrets and Strategies For Established Businesses

Easy SBA #1 Step-by-step guide to apply for a Small Business Loan

Small Loans, Big Dreams, 2022 Edition: Grameen Bank and the Microfinance Revolution in Bangladesh, America, and Beyond

Monthly Payment Amortization Tables for Small Loans: Simple and easy to use reference for car and home buyers and sellers, students, investors, car ... a specific amount, term, and interest rate.

The Insider’s Guide to Business Credit Using an EIN Only: Get Tradelines, Credit Cards, and Loans for Your Business with No Personal Guarantee

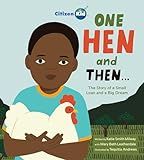

One Hen and Then: The Story of a Small Loan and a Big Dream (CitizenKid)

The SBA Loan Book: Get A Small Business Loan--even With Poor Credit, Weak Collateral, And No Experience

- AFFORDABLE PRICES: QUALITY READS WITHOUT BREAKING THE BANK!

- ECO-FRIENDLY CHOICE: SUPPORT SUSTAINABILITY WITH USED BOOKS.

- UNIQUE FINDS: DISCOVER RARE TITLES AND HIDDEN GEMS TODAY!

Applying for a small loan as a single mother can be a helpful option to address immediate financial needs or cover unexpected expenses. Here are some steps to consider when applying for a small loan:

- Assess your needs: Determine the precise amount of money you need and what purpose it will serve. This will help you approach lenders with a clear request and give them a better understanding of your situation.

- Research lending options: Explore various lending institutions, both traditional banks and online lenders, to compare loan terms, interest rates, and repayment options. Look for lenders that offer loans specifically tailored to the needs of single mothers or borrowers with low income.

- Check eligibility criteria: Review the eligibility requirements laid out by different lenders. Ensure that you meet their criteria before proceeding with the application. Common factors include age, income level, credit score, employment status, and proof of residency.

- Gather financial documents: Prepare the necessary documentation for the application process. This may include proof of income (such as recent pay stubs or tax returns), identification documents (such as a driver's license or social security card), proof of residency (such as utility bills), and any other required paperwork.

- Build a good credit history: Before applying for a loan, it's essential to establish or improve your credit history. Pay your bills on time, reduce existing debts, and avoid taking on additional loans, if possible, to demonstrate fiscal responsibility.

- Prepare a loan proposal: Craft a clear loan proposal that highlights your financial need and how you plan to repay the loan. Include details about your income, expenses, and any supporting documentation that showcases your ability to handle the loan repayments.

- Fill out the loan application: Complete the loan application form accurately and honestly. Provide all required information, ensuring there are no mistakes or omissions that may delay the process or impact your eligibility.

- Submit the application: Once completed, submit your loan application to the lender along with any supporting documents digitally or in person, depending on their preferred method. Ensure you retain copies of all paperwork for your records.

- Follow up and track progress: After submitting your application, stay in touch with the lender to check the progress of your loan approval. Be prepared to provide any additional information they may request promptly.

- Review loan terms: If your loan application is approved, carefully review the loan terms and conditions. Pay close attention to interest rates, repayment schedules, and any associated fees to ensure you understand and can fulfill the loan requirements.

Remember, responsible borrowing is crucial. Only take on a loan if you are confident in your ability to repay it according to the agreed terms.

What are the eligibility requirements for single mothers to apply for a small loan?

The eligibility requirements for single mothers to apply for a small loan may vary depending on the lender or financial institution. However, some common eligibility criteria include:

- Age: Typically, the applicant must be at least 18 years old, although some lenders may require a higher minimum age.

- Income: Single mothers are generally required to have a stable source of income. This can include employment income, government assistance, child support, or alimony. Lenders often have minimum income requirements to ensure that the borrower can repay the loan.

- Credit history: Lenders may review the applicant's credit history to assess their creditworthiness and repayment capacity. While a good credit score can improve the chances of loan approval, some lenders also offer loans for individuals with less-than-perfect credit.

- Citizenship or residency: Proof of citizenship or legal residency is typically required, as lenders typically lend to individuals within their country or region.

- Proof of identification: Lenders will often request identification documents such as a valid government-issued ID card, driver's license, or passport.

- Bank account: Applicants may be required to have a bank account for loan disbursement and repayment purposes.

It's important to note that the specific eligibility requirements can vary, and it is advisable to contact lenders directly or check their website for detailed information on eligibility criteria and documentation needed for small loans for single mothers.

How to find grants or scholarships instead of a small loan for single mothers?

There are several steps you can take to find grants or scholarships specifically for single mothers:

- Research government grants: Start by checking government websites and resources. Governments often offer grants and financial assistance programs specifically designed for single mothers. Look for programs that support education, housing, childcare, or employment.

- Explore nonprofit organizations: Many nonprofit organizations provide grants or scholarships for single mothers. Research local or national organizations that support single mothers and provide financial aid. You can visit their websites or contact them directly to inquire about available funding opportunities.

- Utilize scholarship search engines: There are dedicated scholarship search engines that can help you find scholarships specifically for single mothers. Websites like Fastweb, Scholarships.com, and CollegeBoard offer scholarship databases you can search based on various criteria, including single-parent scholarships.

- Check with colleges and universities: Some educational institutions have scholarships or grants specifically targeted at single mothers. Contact the financial aid offices of colleges or universities you are interested in attending to inquire about any available funding options for single mothers.

- Join support groups and online communities: Joining support groups or online communities for single mothers can provide valuable information about grants or scholarships. Other single mothers may have already gone through the scholarship search process and can offer guidance or share resources they have found.

- Local community resources: Reach out to organizations in your local community, such as churches, nonprofits, or civic groups, to inquire about grants or scholarships for single mothers. These organizations often have programs aimed at supporting single mothers and may offer financial assistance.

Remember to thoroughly research and verify the legitimacy of any scholarships or grants you find to ensure they are from reputable sources. Additionally, consider applying for multiple opportunities as competition can be high. Good luck with your search!

How long does the application process take for a small loan for single mothers?

The application process for a small loan for single mothers can vary depending on the lender and the specific requirements. Typically, it may take a few days to a couple of weeks to complete the application process. This includes submitting the necessary documents, such as proof of income and identification, filling out the application form, and undergoing a credit check. The actual approval time may also vary, but it generally takes a few business days for the lender to review the application and make a decision. It's recommended to contact specific lenders or financial institutions to get a more accurate estimate of the application timeline.

How to find lenders offering small loans for single mothers?

Here are some steps you can take to find lenders offering small loans for single mothers:

- Research government programs: Start by looking into the various government programs and initiatives that provide financial assistance for single mothers. These programs may offer low-interest loans, grants, or other forms of financial aid.

- Research local nonprofit organizations and charities: Many nonprofit organizations and charities offer financial assistance specifically targeted towards single mothers. Look for organizations in your local area that provide small loans or grants to single mothers in need.

- Contact local credit unions: Credit unions are known for offering more personalized and flexible loan options compared to traditional banks. Reach out to credit unions in your area to inquire about small loan options specifically designed for single mothers.

- Explore online lending platforms: There are several online lending platforms that specialize in providing small loans to individuals with various financial needs. Do thorough research and read reviews to ensure the platform is reputable and offers favorable terms.

- Seek assistance from local community organizations: Reach out to community organizations such as women's shelters, community centers, or social service agencies. These organizations often have resources and connections to lenders who provide loans to single mothers.

- Utilize online loan comparison websites: Use online loan comparison websites to search for lenders that specifically cater to single mothers. These websites allow you to compare loan terms, interest rates, and eligibility requirements from multiple lenders in one place.

- Build a strong credit history: Work on improving your credit score by paying bills on time, reducing existing debt, and regularly checking your credit report for any errors. A stronger credit history may increase your chances of obtaining favorable loan offers.

Remember to carefully review the terms and conditions of any loan offer and ensure that the lender is reputable and trustworthy. It's also important to borrow only what you can afford to repay to avoid getting into further financial difficulties.