Best Real Estate Investment Strategies to Buy in February 2026

The Book on Rental Property Investing: How to Create Wealth With Intelligent Buy and Hold Real Estate Investing (BiggerPockets Rental Kit, 2)

Real Estate Investment and Finance: Strategies, Structures, Decisions (Wiley Finance)

Buy, Rehab, Rent, Refinance, Repeat: The BRRRR Rental Property Investment Strategy Made Simple

Real Estate Finance and Investments: Risks and Opportunities Edition 5.3

The Millionaire Real Estate Investor

- COMPREHENSIVE MARKET INSIGHTS FOR INFORMED INVESTMENT DECISIONS.

- EXPERT STRATEGIES FOR MAXIMIZING PROPERTY VALUE AND ROI.

- NETWORKING OPPORTUNITIES WITH INDUSTRY LEADERS AND INVESTORS.

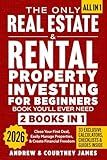

The Only Real Estate & Rental Property Investing For Beginners Book You'll Ever Need (2 in 1): Close Your First Deal, Easily Manage Properties, & Create Financial Freedom (Start A Business)

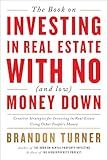

The Book on Investing In Real Estate with No (and Low) Money Down: Creative Strategies for Investing in Real Estate Using Other People's Money (BiggerPockets Rental Kit, 1)

One way to invest in real estate without actually buying property is through real estate investment trusts (REITs). REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. By investing in REITs, you can gain exposure to the real estate market without the hassle of directly owning and managing properties.

Another way to invest in real estate without buying property is through real estate crowdfunding platforms. These platforms allow investors to pool their money together to invest in a variety of real estate projects, such as residential developments, commercial properties, or even real estate debt. This can be a more accessible way for investors to diversify their real estate holdings without the large capital required for traditional property investments.

Additionally, you can also invest in real estate through real estate mutual funds or exchange-traded funds (ETFs). These funds invest in a diversified portfolio of real estate assets, providing investors with exposure to the real estate market without the need to directly own and manage properties. This can be a more passive way to invest in real estate and benefit from potential income and appreciation.

What are some creative ways to invest in real estate without buying a house?

- Real estate crowdfunding platforms: Invest in real estate projects through online platforms that pool funds from multiple investors to collectively invest in properties.

- Real estate investment trusts (REITs): Purchase shares of a publicly traded REIT, which owns and operates income-producing real estate properties, allowing you to benefit from rental income and property appreciation without owning physical property.

- Real estate mutual funds: Invest in mutual funds that focus on real estate investments, providing you with exposure to a diversified portfolio of real estate assets.

- Real estate notes: Invest in real estate debt by purchasing mortgage notes or investing in real estate-based loans, allowing you to earn interest income without directly owning property.

- Real estate partnerships: Form partnerships with experienced real estate investors or developers to invest in real estate projects together, sharing both the risks and rewards of the investment.

- Real estate ETFs: Invest in exchange-traded funds (ETFs) that track real estate indices or portfolios of real estate securities, providing you with a diversified exposure to the real estate market.

- Lease options: Enter into lease option agreements with property owners, allowing you to control and potentially purchase the property at a predetermined price in the future, while earning rental income in the meantime.

- Real estate wholesaling: Act as a middleman by finding and negotiating deals on real estate properties, then assigning the contracts to other investors for a fee, without actually owning the property yourself.

What is the most profitable way to invest in real estate without buying?

One of the most profitable ways to invest in real estate without buying property is through real estate investment trusts (REITs). REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. By investing in REITs, individuals can gain exposure to the real estate market without having to directly own or manage properties.

Another way to profit from real estate without buying is through real estate crowdfunding platforms. These platforms allow investors to pool their resources to invest in specific real estate projects, such as commercial developments or residential properties. By investing in real estate crowdfunding, individuals can diversify their investments and potentially earn passive income without the need to directly manage properties.

Additionally, investing in real estate mutual funds or exchange-traded funds (ETFs) can be a profitable way to gain exposure to the real estate market without buying property. These funds typically invest in a diversified portfolio of real estate assets, providing investors with broader exposure to the real estate market and potential for long-term growth.

Overall, investing in REITs, real estate crowdfunding, or real estate mutual funds/ETFs can be profitable ways to gain exposure to the real estate market and generate income without the responsibilities of property ownership. It's important to carefully research and consider all investment options to determine which best aligns with one's financial goals and risk tolerance.

How can I diversify my real estate investments without purchasing a property?

- Real Estate Investment Trusts (REITs): Purchase shares of a REIT, which is a company that owns and manages income-producing real estate properties. This allows you to invest in a diversified portfolio of real estate without the need to directly own properties.

- Real Estate Crowdfunding Platforms: Invest in real estate projects through crowdfunding platforms, where you can pool your money with other investors to fund a specific project or property. This allows you to invest in a variety of properties across different locations and asset classes.

- Real Estate ETFs and Mutual Funds: Invest in exchange-traded funds (ETFs) or mutual funds that focus on real estate, providing exposure to a diversified portfolio of real estate assets. This allows you to gain exposure to the real estate market without the need to directly own properties.

- Real Estate Syndications: Participate in real estate syndications, where a group of investors pool their capital to invest in a specific real estate project. This allows you to invest in larger commercial properties or developments without the need for significant capital or management responsibilities.

- Real Estate Notes: Purchase mortgage notes or other debt instruments tied to real estate assets, which allows you to earn passive income through interest payments while diversifying your real estate investments.

- Real Estate Investment Platforms: Utilize online investment platforms that offer a range of real estate investment options, such as rental properties, commercial real estate, or fix-and-flip projects. These platforms typically offer a variety of investment opportunities and allow you to diversify your real estate portfolio.

How to invest in real estate without needing a large down payment?

- Consider partnering with someone: One option is to find a partner who is willing to provide the larger down payment in exchange for a share of the rental income or profit from the property.

- Utilize seller financing: Some sellers may be willing to finance a portion of the purchase price, allowing you to make a smaller down payment and pay the remaining amount in installments.

- Look for properties that qualify for low down payment loans: Some loans, such as FHA loans, require only a small down payment, making it easier to purchase a property with minimal upfront costs.

- Explore lease options: With a lease option, you can rent a property with the option to purchase it at a later date. This can be a way to build equity in a property without needing a large down payment at the outset.

- Consider investment strategies that require little or no down payment, such as wholesaling or house hacking, where you live in one unit of a multi-family property and rent out the other units.

- Save up for a down payment: If none of the above options are feasible, consider saving up for a down payment over time. Cut expenses, increase your income, and save diligently to reach your goal of investing in real estate.

How to invest in real estate without buying property?

There are several ways to invest in real estate without buying physical property. Here are some popular options:

- Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-producing real estate across various sectors. Investors can buy shares of publicly-traded REITs on stock exchanges, giving them exposure to real estate without having to directly purchase property.

- Real Estate Crowdfunding: Real estate crowdfunding platforms allow individuals to invest in real estate projects, such as new developments or rental properties, alongside other investors. This option offers diversity and flexibility in terms of investment sizes and property types.

- Real Estate Syndications: In a real estate syndication, a group of investors pool funds to invest in a specific property or real estate project. This option allows investors to access larger, potentially higher-yielding deals that they may not have been able to participate in individually.

- Real Estate ETFs or Mutual Funds: Similar to REITs, real estate exchange-traded funds (ETFs) or mutual funds provide exposure to a diversified portfolio of real estate assets. Investors can buy shares in these funds to gain exposure to the real estate market as a whole.

- Real Estate Notes: Investing in real estate notes involves purchasing debt instruments, such as mortgage loans or promissory notes, secured by real estate. Investors receive interest payments from the borrower as well as potential principal repayment.

It's important to conduct thorough research and seek advice from financial professionals before investing in real estate through alternative methods. Each option has its own risks and potential returns, so it's essential to understand your investment goals and risk tolerance before making any decisions.

What are some alternative ways to invest in real estate?

- Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. Investors can buy shares of REITs on the stock exchange like any other publicly traded company.

- Real Estate Crowdfunding: There are online platforms that allow individuals to invest in real estate projects by pooling their resources with other investors. This allows for smaller investments in larger properties, and provides access to a diverse range of real estate projects.

- Real Estate Partnerships: Investors can partner with others to invest in real estate properties. This can be done through private partnerships or syndications, where each investor contributes capital and shares in the profits and losses of the property.

- Real Estate Exchange-Traded Funds (ETFs): ETFs are similar to REITs, but instead of owning shares in individual companies, investors own shares in a fund that holds a diversified portfolio of real estate assets. ETFs can provide exposure to different types of properties and geographic regions.

- Direct Ownership: Investors can purchase properties outright and manage them themselves or hire a property management company to handle day-to-day operations. This allows for full control over the investment property and potential for higher returns, but also comes with greater risks and responsibilities.