Best Health Stocks to Buy in March 2026

Mastering Stocks and Broths: A Comprehensive Culinary Approach Using Traditional Techniques and No-Waste Methods

Nu-Stock Wound Cream

- NON-TOXIC FORMULA ENSURES SAFETY FOR ALL ANIMALS.

- PROVEN RELIEF FOR MANGE, RINGWORM, EAR MITES, AND MORE.

- HEALS SKIN EFFECTIVELY FROM THE INSIDE OUT.

Kroma’s 24K Chicken Bone Broth Powder - 7 Pack, 7 Servings – Organic Protein-Rich Bone Stock – Instant Packaged Broths for Joint Health — 24K Chicken Protein Powder for Gut Health & Daily Wellness

- BOOST IMMUNITY & DIGESTION WITH ORGANIC BONE BROTH BENEFITS

- PROTEIN-PACKED: 12G PER SERVING FOR JOINT & SKIN SUPPORT

- QUICK & EASY TO PREPARE: NOURISHMENT IN SECONDS

![Broth and Stock from the Nourished Kitchen: Wholesome Master Recipes for Bone, Vegetable, and Seafood Broths and Meals to Make with Them [A Cookbook]](https://cdn.blogweb.me/1/416_F8_BP_37_YL_SL_160_7cd2e353de.jpg)

Broth and Stock from the Nourished Kitchen: Wholesome Master Recipes for Bone, Vegetable, and Seafood Broths and Meals to Make with Them [A Cookbook]

![Broth and Stock from the Nourished Kitchen: Wholesome Master Recipes for Bone, Vegetable, and Seafood Broths and Meals to Make with Them [A Cookbook]](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![Broth and Stock from the Nourished Kitchen: Wholesome Master Recipes for Bone, Vegetable, and Seafood Broths and Meals to Make with Them [A Cookbook]](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

The Book of Questions: Revised and Updated

- ENGAGE READERS WITH THOUGHT-PROVOKING, STIMULATING QUESTIONS.

- BOOST CONVERSATIONS AND CONNECTIONS WITH MEANINGFUL DISCUSSIONS.

- VERSATILE FOR ALL AGES, PERFECT FOR FAMILY GATHERINGS OR EVENTS.

Paradise Naturals 100% Grass-Fed Natural Beef Bone Broth Powder + Active Probiotics, Collagen, 15g Protein, Non-GMO, Low Sodium, Gut Health, Paleo, Keto, Gluten-Free, for Healthy Skin, Hair, Joints

- SLOW-SIMMERED FOR 30-40 HOURS FOR MAXIMUM NUTRIENT RICHNESS.

- BOOST YOUR WELLNESS WITH OUR UNIQUE PROBIOTICS FOR GUT HEALTH!

- SMOOTH, INSTANT DISSOLVING FOR EASY ADDITION TO ANY DRINK OR DISH.

Stetson Preferred Stock - Cologne Spray for Men - Leathery, Woody, and Casual Aroma with Fragrance Notes of Cypress, Balsam Fir, and Sandalwood - 2.5 Fl Oz

- TRAVEL-FRIENDLY DESIGN: FITS EASILY IN BAGS FOR ON-THE-GO FRESHNESS.

- VERSATILE SCENT PROFILE: PERFECT FOR ANY OCCASION-EARTHY AND MASCULINE.

- ICONIC BRAND HERITAGE: STETSON EVOKES RUGGED INDIVIDUALISM AND FREEDOM.

Investment Guidebook For Teens: The Ultimate Start To Growing Your Wealth Before 21 From Basics To Big Wins In Stocks, Bonds, Crypto And Beyond (Therapy and Mental Health Books For Teens)

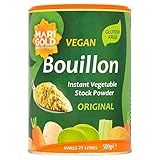

Marigold Health Foods Bouillon Instant Vegetable Stock Powder 500 g - Vegan & Gluten Free - Makes 25 Litres

- ENJOY A DELICIOUS HOT DRINK WITH JUST 12 CALORIES PER CUP!

- VERSATILE FLAVOR ENHANCER FOR SOUPS, SAUCES, AND CASSEROLES.

- GLUTEN-FREE AND VEGETARIAN-FRIENDLY FOR ALL DIETARY NEEDS!

To invest in UnitedHealth Group stock (UNH), individuals can start by opening a brokerage account with a reputable online brokerage firm. They can then research the company to understand its financial health, performance, and prospects for growth. After conducting thorough research, investors can place an order to buy UNH stock through their brokerage account. It is crucial to consider factors such as the stock price, company earnings, and market trends before making an investment decision. Additionally, it is advisable to diversify your investment portfolio to mitigate risk. It is important for investors to monitor their UNH stock holdings regularly and stay informed about any developments that may impact the company's performance.

What is the competitive landscape for UnitedHealth Group in the healthcare industry?

UnitedHealth Group operates in the highly competitive healthcare industry, where it faces competition from other insurers, healthcare providers, pharmacy benefit managers, and technology companies. Some of the key competitors of UnitedHealth Group include:

- Anthem Inc.: Anthem is one of the largest health insurance companies in the United States, offering a range of health insurance products and services.

- CVS Health: CVS Health is a pharmacy benefit manager and healthcare company that also operates a network of retail pharmacies and clinics, making it a direct competitor to UnitedHealth Group's OptumRx business.

- Cigna Corporation: Cigna is a global health services company that offers a variety of health insurance and related products, including pharmacy benefit management.

- Humana Inc.: Humana is a health insurance company that primarily focuses on Medicare Advantage plans, but also offers commercial health insurance products.

- Aetna Inc.: Aetna is a major health insurance company that was acquired by CVS Health in 2018, creating a formidable competitor in the healthcare industry.

- Centene Corporation: Centene is a managed care organization that focuses on government-sponsored healthcare programs, such as Medicaid and Medicare.

- Optum: Optum is a subsidiary of UnitedHealth Group that provides a wide range of healthcare services, including pharmacy benefit management, care delivery, and health information technology. Optum competes with other healthcare services and technology companies in the industry.

Overall, UnitedHealth Group competes with a diverse set of competitors in the healthcare industry, each offering a range of products and services aimed at meeting the needs of consumers, employers, and government entities. The company's ability to innovate, provide high-quality care at lower costs, and effectively navigate the changing healthcare landscape will be key in maintaining its competitive position in the industry.

What is the dividend yield of UnitedHealth Group Stock?

As of October 2021, UnitedHealth Group does not pay a dividend yield.

What is the management team of UnitedHealth Group like?

The management team of UnitedHealth Group is comprised of experienced and knowledgeable individuals who bring diverse backgrounds and expertise to the company. The team is led by David S. Wichmann, who serves as the Chief Executive Officer. In addition to Wichmann, the management team includes leaders in areas such as finance, operations, technology, and human resources. Overall, the management team is committed to driving the company's growth and success by focusing on innovation, efficiency, and delivering quality healthcare services to customers.

How to invest in UnitedHealth Group Stock for the long term?

- Do your research: Before investing in UnitedHealth Group stock for the long term, it is important to thoroughly research the company, its financials, business model, competitive position, and industry trends. Look into the company's past performance, future growth potential, and any potential risks.

- Set long-term investment goals: Determine your investment objectives and time horizon before investing in UnitedHealth Group stock. Consider how long you plan to hold the stock and what your financial goals are.

- Consult with a financial advisor: A financial advisor can help you assess your risk tolerance, investment horizon, and financial goals to determine if UnitedHealth Group stock is a suitable investment for you. They can also provide insights into the stock market and help you create a diversified investment portfolio.

- Open a brokerage account: In order to invest in UnitedHealth Group stock, you will need to open a brokerage account. Research different brokerage firms and choose one that offers the features and services that align with your investment needs.

- Purchase UnitedHealth Group stock: Once you have set up your brokerage account, you can purchase UnitedHealth Group stock through your broker. Keep in mind that it is important to invest only money that you can afford to lose and to diversify your investment portfolio to mitigate risk.

- Monitor your investment: Regularly monitor the performance of your UnitedHealth Group stock investment and stay updated on company news, industry trends, and market conditions. Consider rebalancing your portfolio as needed to align with your long-term investment goals.

- Stay committed to your investment strategy: Investing in UnitedHealth Group stock for the long term requires patience and discipline. Resist the urge to make emotional decisions based on short-term market fluctuations and stay focused on your long-term investment objectives.

What is the tax implication of investing in UnitedHealth Group Stock?

Investing in UnitedHealth Group stock may have tax implications depending on the type of account in which the investment is held. If the investment is held in a taxable brokerage account, any capital gains realized upon the sale of the stock will be subject to capital gains tax. The tax rate for capital gains depends on how long the stock was held before being sold.

If the investment is held in a tax-advantaged account such as a 401(k) or individual retirement account (IRA), any gains realized upon the sale of the stock would not be subject to immediate capital gains tax. However, withdrawals from these accounts may be subject to income tax depending on the type of account and the investor's age.

It is important to consult with a tax professional or financial advisor to understand the specific tax implications of investing in UnitedHealth Group stock based on your individual circumstances.