Best Trading Books to Buy in March 2026

Trading: Technical Analysis Masterclass: Master the financial markets

- MASTER TECHNICAL ANALYSIS FOR PROFITABLE TRADING STRATEGIES.

- UNLOCK FINANCIAL MARKET INSIGHTS WITH EXPERT GUIDANCE.

- ENJOY DURABLE, PREMIUM QUALITY MATERIAL FOR LASTING USE.

Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude

- PERFECT FOR AVID READERS SEEKING ENGAGING CONTENT.

- IDEAL GIFT CHOICE FOR BOOK ENTHUSIASTS AND COLLECTORS.

- ELEVATE YOUR READING EXPERIENCE WITH PRENTICE HALL PRESS!

How to Day Trade for a Living: A Beginner’s Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing)

- FREEDOM TO WORK FROM ANYWHERE, ANYTIME-BE YOUR OWN BOSS!

- ACHIEVE SUCCESS WITH THE RIGHT TOOLS AND A DEDICATED MINDSET.

- STAND OUT WITH HARD WORK AND PERSEVERANCE FOR LASTING GAINS.

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

- PERFECT GIFT FOR BOOK LOVERS OF ALL AGES!

- A MUST-HAVE FOR EVERY BOOKWORM'S COLLECTION.

- TRAVEL-FRIENDLY DESIGN FOR READING ON THE GO!

Best Loser Wins: Why Normal Thinking Never Wins the Trading Game – written by a high-stake day trader

How to Day Trade: The Plain Truth

The Trader's Handbook: Winning habits and routines of successful traders

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.blogweb.me/1/41e_Ap_i_Cp_LL_SL_160_b5b13e0178.jpg)

The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.blogweb.me/1/51_Jozc_NDI_6_L_SL_160_9dc836f80d.jpg)

The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

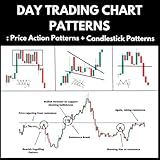

Day Trading Chart Patterns : Price Action Patterns + Candlestick Patterns

In the world of trading, the trading book is an essential tool that holds important financials concerning financial organizations. It is these financials that are traded or sold for one reason or another. They may even be purchased in order to help trading run smoothly. The size of the trading book can vary and may be dependent on a financial organizations ultimate size as well.

There are several good trading books and the best one is determined by the financial organization. To have a better understanding of what makes a trading book great, we need to understand what trading is.

What is trading and how it works?

Trading is a financial term relating to the trading of company stock that is owned by individuals.

The ability to make a trade can occur two different ways, either by individual traders within the exchange itself or through electronic methods.

Via Individual Stock Market Traders

Whether it is on the market floor trading stock or forex, this is the method most people visualize when it comes to trading. Although this may be true most of the time, it is not the only method available. Sure, many traders scurry around yelling their trade out, but when it is all said and done, the stressful day settles down.

For a trade to be completed, there are a few steps to take in order for a stock or forex trade to be accomplished.

- A buy is placed for a certain amount of shares

- Buy order is sent to and received by their exchange clerk

- The exchange clerk contacts a trader who then contacts a trader of the company stock to be obtained and sells the requested shares.

- A Price is then agreed upon and the trade is completed. The confirmation and notification then heads back to the original buyer.

Electronically

Today’s world is moving rapidly and there is a lot of doubt concerning the market’s ability to withstand a manual system. However, the good news is that there are electronic versions for the stock market.

Although the electronic versions of the market remain fairly new, it is an efficient means to conduct trades. In fact, quite a few organizations utilize electronic trading to save time and money.

Regardless though, trade brokers are still important in the world of trading as the electronic access is not readily available to the individual investor. You can find here sample of financial investment proposals.

What skills do you need for trading?

With a lot to gain with trading on the stock market as well as with forex, it seems like you don’t need that much skill in order to make some good money through trades. However, there are a few skills that are seen as being essential for trading forex.

- Basic grasp of the forex market

- Provide record keeping that is precise

- Intellectual control and resiliency

- Intense ability to analyze

How much do day traders make?

Day traders are a part of one of the most popular financial markets known. Besides that, the field is also known to involve the trading of large amounts of money. In order to make a trade, a trader’s account must have a minimum of $25,000 available. To be safe, it is best to have a nice cushion that is over the minimum amount.

So let’s say you have an account with $35,000. With that amount you are able to take a risk of $350 for every trade you make. This will then create a $0.15 stop loss, which will allow you to obtain 3500 stock shares. In order for you to achieve these results, it will be necessary to make stock trades with good volatility and a nice size.

When good systems ae utilized you will have a 50-50 chance of coming out ahead. By trading at least 5 times in a day, it can calculate to at least 100 monthly trades within 20 days.

- Half of the trades will be profitable, earning you $26,250

- Half of the trades will be a loss of $17,500

The net amount that you will earn will be around $8,750. With this you still need to account for fees and other possible commissions to pay.

What is the trading book?

Basically speaking a trading book is what a financial organization implements to keep an accurate accounting of financial dealings that the organization holds and buys and sells. It also keeps track of all history concerning trades through simple methods that evaluate the past events. It is important to not get this confused with banking books because the trading book securities are seen as being held only for a short period of time while banking book securities will be kept for a longer period of time.

Financial holdings within the trading book needs to be available for the trading process.

Every trading book is prone to any and all gains or losses as the price of trades vary constantly. Due to the financial organization holding onto the securities, the organization is affected directly due to the fluctuations of the losses and/or gains experienced.