Best Credit Repair Tools to Buy in February 2026

20 Piece Ultra Thin Plastic Opening Card Repair Tool for Mobile Phone Laptop Tablet Disassemble LCD Screen Opener Remover

- COMPACT CREDIT CARD SIZE FOR EASY PORTABILITY AND CONVENIENCE.

- ULTRA-THIN TOOL FITS EASILY INTO TIGHT GAPS FOR VERSATILE USE.

- IDEAL FOR DELICATE TASKS: PRYING, SCRAPING, AND SPREADING PASTE.

Weenkilly 11-in-1 Credit Card Multitool For Men, 10 Pack Survival Pocket Tools, Thickened Stainless Steel Bottle Opener, Credit Card Wallet Tool, Double Row Sawtooth Pocket Tool

-

11 TOOLS IN 1: ALWAYS READY FOR ANY TASK OR EMERGENCY!

-

COMPACT DESIGN: FITS EASILY IN WALLETS OR POCKETS FOR ON-THE-GO USE!

-

DURABLE STAINLESS STEEL: BUILT TO LAST, RUST-RESISTANT & RELIABLE!

iFixit Prying and Opening Tool Assortment - Electronics, Phone, Laptop, Tablet Repair

- DIY FRIENDLY: EFFORTLESSLY DISASSEMBLE TECH DEVICES FOR REPAIRS.

- ALL-IN-ONE KIT: COMPLETE SET OF PROFESSIONAL TOOLS FOR EVERY GADGET.

- UNIVERSAL USE: PERFECT FOR IPHONES, LAPTOPS, TABLETS, AND MORE!

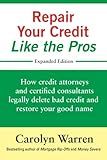

Repair Your Credit Like the Pros: How credit attorneys and certified consultants legally delete bad credit and restore your good name

SANHOOII 85 * 54 * 0.3mm Plastic Card Pry Opening for Tablet Mobile Phone Battery Glued Remover LCD Screen Repair Tool (10 Pieces)

- COMPACT DESIGN FITS IN WALLET FOR CONVENIENCE ON-THE-GO.

- PERFECT FOR DELICATE TASKS: PRY, SCRAPE, AND SPREAD WITH EASE!

- ESSENTIAL TOOL FOR DISASSEMBLING DEVICES AND REMOVING ADHESIVES.

Credit Card Tool Multitool, Christmas Stocking Stuffers 18 in 1 Cool Gadgets, Useful Fathers Gift for Dad, Upgraded Multi-Tool Birthday Gifts Men Women Survival Wallet Tools with Screwdrivers Compass

- 🎁 EXQUISITE GIFT BOX MAKES IT PERFECT FOR ANY SPECIAL OCCASION!

- 🔧 18-IN-1 TOOLS HANDLE EVERYDAY TASKS WITH EASE AND STYLE!

- 🏕️ ULTRA-LIGHTWEIGHT AND PORTABLE FOR ON-THE-GO CONVENIENCE!

When applying for a loan with poor credit, there are a few steps you can take to improve your chances of approval:

- Understand your credit situation: Start by obtaining a copy of your credit report to review your credit history. Identify any errors or discrepancies that may be negatively impacting your score.

- Find the right lender: Look for lenders who offer loans specifically for individuals with poor credit. Many online lenders specialize in serving borrowers with less-than-perfect credit scores.

- Prepare necessary documents: Gather documents typically required for loan applications, such as proof of income, identification, and bank statements. Ensure you have all the necessary paperwork in order before applying.

- Explain your situation: When applying, provide a clear and honest explanation of your credit situation. Detail any extenuating circumstances that may have contributed to your poor credit, such as job loss, divorce, or medical expenses.

- Offer collateral or get a cosigner: If possible, provide collateral for the loan, such as a vehicle or property. This may help mitigate the risk for the lender. Alternatively, finding a cosigner with good credit can also increase your chances of approval.

- Explore loan alternatives: If traditional lenders reject your application due to poor credit, consider alternative options such as credit unions or peer-to-peer lending platforms. These may have more flexible requirements or lower interest rates.

- Improve your credit: While applying for a loan, take steps to improve your credit score. Make timely payments, reduce your outstanding debts, and avoid applying for new credit. These positive actions can gradually rebuild your creditworthiness for future financial endeavors.

Remember, obtaining a loan with poor credit may come with higher interest rates and stricter terms. It's important to carefully review the terms of any loan offer and budget accordingly to ensure you can make the repayments on time.

How to improve your chances of getting approved for a loan with bad credit?

Improving your chances of getting approved for a loan with bad credit can be challenging, but not impossible. Here are six steps to improve your chances:

- Review your credit report: Obtain a copy of your credit report from the major credit bureaus (Equifax, Experian, and TransUnion) and carefully review it for errors or inaccuracies. If you find any discrepancies, immediately dispute them to improve your credit score.

- Build a strong repayment history: Consistently make on-time payments for all your debts, including credit cards, loans, and utility bills. This will demonstrate to lenders that you are becoming responsible with your financial obligations.

- Pay off outstanding debts: Prioritize paying off any outstanding debts you have, such as credit card balances or old collections. Reducing your debt-to-income ratio will improve your creditworthiness and increase the chances of loan approval.

- Offer collateral or a co-signer: Providing collateral (such as a valuable asset) or having a co-signer with good credit can help you secure a loan despite bad credit. Collateral acts as security for the lender, while a co-signer promises to repay the loan if you default.

- Explore alternative lending options: Traditional banks and credit unions may be less willing to lend to individuals with bad credit. However, there are alternative lenders, online lenders, or credit unions that specialize in offering loans to those with less-than-perfect credit. Research these options and compare their terms and interest rates.

- Prepare a strong loan application: When applying for a loan, thoroughly prepare your application. Provide accurate and complete information about your income, employment history, and any assets you possess. Include documentation that showcases your ability to repay the loan.

It's important to keep in mind that improving your credit score may take time, so be patient and consistent in your efforts.

How to build credit while repaying a loan with poor credit?

Building credit while repaying a loan with poor credit can be challenging, but it is not impossible. Here are several strategies you can use to build credit during this time:

- Make timely loan payments: Ensure you make all loan payments on time. Late or missed payments will further damage your credit score. Consistently making on-time payments will gradually demonstrate responsible behavior to lenders.

- Pay more than the minimum: If possible, pay more than the minimum payment each month. These additional payments can help reduce the loan balance faster, which positively affects your credit utilization ratio.

- Diversify your credit: While repaying the loan, consider adding other types of credit to your profile. This could be a secured credit card, where you deposit a certain amount of money as collateral and use the card regularly while making timely payments.

- Keep credit utilization low: Maintain a low credit utilization ratio by not using your credit card excessively. Ideally, keep your credit utilization below 30% of your credit limit.

- Monitor your credit report: Regularly check your credit report to ensure there are no errors or fraudulent activities. If any discrepancies are found, dispute them promptly to protect your credit score.

- Seek alternative loan options: If possible, try to obtain a secured loan with collateral, such as a car or savings account. Although interest rates may be higher, having a secured loan can help build positive credit history.

- Become an authorized user: If you have a close friend or family member with good credit, ask them to add you as an authorized user on their credit card. Ensure they have a good payment history, as it will reflect positively on your credit report.

- Avoid new credit applications: Limit the number of new credit applications during this time. Multiple inquiries can negatively impact your credit score.

Remember, building credit takes time, discipline, and consistent financial behavior. Don't expect rapid improvements, but continue practicing responsible credit habits to gradually rebuild your creditworthiness.

How to repair your credit after successfully applying for a loan with poor credit?

Repairing your credit after successfully applying for a loan with poor credit is a necessary step to improve your overall financial health. Here are some steps you can take to repair your credit:

- Review your credit report: Obtain a copy of your credit report from the major credit bureaus (Experian, Equifax, and TransUnion). Look for any errors, inaccuracies, or discrepancies that may negatively impact your score. Dispute any incorrect information and request corrections.

- Pay bills on time: Prioritize paying all your bills on time to demonstrate responsible financial behavior. Late payments can have a significant negative impact on your credit score.

- Reduce outstanding debt: Create a budget and develop a plan to pay off your outstanding debt. Focus on high-interest loans or credit cards first. Consider debt consolidation to simplify payments and possibly reduce interest rates.

- Maintain low credit utilization: Aim to utilize no more than 30% of your available credit. Keeping your credit card balances low shows lenders that you manage credit responsibly.

- Build a positive credit history: Consider obtaining a secured credit card, which requires a deposit as collateral. Use it responsibly and make regular payments to build a positive credit history.

- Diversify your credit mix: Lenders prefer to see a mix of credit types, such as credit cards, loans, and mortgages. If possible, consider obtaining a small personal loan or a secured loan to diversify your credit mix.

- Avoid new credit applications: Refrain from applying for multiple credit cards or loans within a short period. Each application results in a hard inquiry, which temporarily lowers your credit score.

- Be patient and persistent: Rebuilding credit takes time, so be patient and committed to improving your credit habits. Consistently practicing responsible financial behavior will gradually improve your credit score.

- Seek professional help if needed: If you're overwhelmed or struggling to repair your credit, consider working with a reputable credit counseling agency. They can provide guidance and develop a customized plan to help you rebuild your credit.

Remember, repairing your credit is a process that requires discipline and consistency. By following these steps and maintaining responsible financial habits, you can gradually improve your credit score over time.

How to gather necessary documentation for a loan application?

Gathering necessary documentation for a loan application involves organizing and preparing your financial information. Here are the steps to follow:

- Review the loan application requirements: Start by going through the loan application form or speaking to the loan officer to understand what documents are required. Loan requirements may vary depending on the type of loan, lender, and your personal circumstances.

- Financial documents: Gather your financial documents, including: Income proof: Pay stubs, W-2 forms, tax returns (usually the past two years), or bank statements showing business income if self-employed. Employment details: Employment verification letter or contact details of your employer. Asset details: Statements of bank accounts, investment accounts, retirement accounts, or any other assets you own. Liabilities: Records of current loans, credit card balances, or other outstanding debts. Identification: Provide copies of your ID, such as a driver's license or passport.

- Personal information: Collect personal documents, such as: Social Security number: Have your Social Security card or written down for reference. Residence and rental history: Information about your current and previous addresses, including landlord contacts. References: Provide personal references or character references as requested.

- Collateral documents: If you are applying for a secured loan, like a mortgage or auto loan, additional documentation might be needed. Examples include: Property details: For a mortgage, gather property information, purchase contract, appraisal reports, or insurance details. Title documents: For an auto loan, have the vehicle's title, registration, and insurance information ready.

- Miscellaneous documents: Depending on your circumstances or the loan type, you might need additional documents, such as: Divorce decree: If applicable, provide divorce papers to verify any alimony or child support payments. Court documents: In some cases, legal documents like bankruptcy records or child custody agreements may be necessary. Proof of down payment: If you're buying a home or making a down payment, provide proof of funds, such as bank statements.

- Make copies and organize the documents: Make photocopies or scan the necessary documents for your own records. Organize everything in a systematic way, creating separate folders or a digital file for each category.

- Keep documents up to date: Ensure that all the documents are current and match the information provided on the loan application. If anything changes during the loan processing period, keep the documents updated.

Remember to double-check with your lender or loan officer for specific document requirements to ensure you have everything necessary for your loan application.