Best Boring Company Investments to Buy in March 2026

Company of Heroes: My Life as an Actor in the John Ford Stock Company

Allen Company Deluxe Buttstock Shell Holder & Accessory Pouch

-

UNIVERSAL FIT: SECURELY ATTACHES TO ANY RIFLE BUTTSTOCK-NO TOOLS NEEDED!

-

FAST ACCESS: QUICK-RELOADING WITH INDIVIDUAL ELASTIC SHELL LOOPS FOR 5 ROUNDS.

-

CONVENIENT STORAGE: DUAL-PURPOSE POUCH FOR ACCESSORIES KEEPS YOU ORGANIZED.

The Neatest Little Guide to Stock Market Investing: Fifth Edition

Stock Investing for Dummies

- EXPERT INSIGHTS FROM PAUL MLADJENOVIC ENHANCE YOUR INVESTING SKILLS.

- EASY-TO-UNDERSTAND STRATEGIES SIMPLIFY STOCK MARKET NAVIGATION.

- UPDATED CONTENT REFLECTS CURRENT MARKET TRENDS AND BEST PRACTICES.

How To Make Money In Stocks: A Winning System in Good Times or Bad, 3rd Edition

Stock Investing For Dummies: Fourth Edition

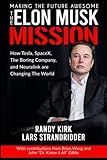

The ELON MUSK MISSION - Making The Future Awesome: How Tesla, SpaceX, The Boring Company, and Neuralink are Changing the World (The Amazing Future with Elon Musk)

To buy The Boring Company stock, you can start by opening an account with a brokerage firm that offers access to over-the-counter (OTC) stocks. You can then search for The Boring Company's stock symbol, which may be listed under the parent company, such as Elon Musk's Tesla. Once you have found the stock, you can place an order to buy shares through your brokerage account. It is important to do thorough research on the company and its stock performance before making any investment decisions. Keep in mind that investing in OTC stocks can be riskier than investing in stocks on major exchanges, so make sure you are comfortable with the potential risks involved.

What is the 52-week high and low of The Boring Company stock?

As of September 2021, The Boring Company is not a publicly traded company and therefore does not have a stock price, 52-week high, or 52-week low.

What is the risk associated with investing in The Boring Company stock?

There are several risks associated with investing in The Boring Company stock, including:

- Lack of profitability: The Boring Company is still a relatively new and unproven company, and there is no guarantee that they will be able to achieve profitability in the future. This could result in a loss on your investment.

- Technological and regulatory risks: The company's tunneling technology is still in the early stages of development, and there is a risk that it may not work as intended or may face regulatory hurdles that could delay or prevent its deployment.

- Competition: The Boring Company operates in a highly competitive industry, with many other companies working on similar tunneling and transportation projects. There is a risk that the company may not be able to compete effectively against these competitors.

- Economic risks: The success of The Boring Company is also dependent on the overall economic environment, including factors such as interest rates, inflation, and consumer spending. A downturn in the economy could negatively impact the company's performance and stock price.

- Lack of diversification: Investing in a single company like The Boring Company can be risky, as you are relying on the success of just one business. It is important to have a diverse investment portfolio to spread out risk.

Overall, investing in The Boring Company stock carries a high level of risk and investors should carefully consider these factors before making any investment decisions.

How to calculate the potential return on The Boring Company stock investment?

To calculate the potential return on The Boring Company stock investment, you can use the formula for calculating the return on investment (ROI):

ROI = (Ending Value of Investment - Initial Cost of Investment) / Initial Cost of Investment

- Determine the initial cost of your investment in The Boring Company stock. This would be the amount of money you initially invested in purchasing the stock.

- Determine the ending value of your investment. This can be calculated by multiplying the current stock price of The Boring Company by the number of shares you own.

- Plug these values into the formula and calculate the ROI. This will give you a percentage that represents the potential return on your investment in The Boring Company stock.

Keep in mind that this is a simplified calculation and does not take into account factors such as dividends, taxes, or commissions. It's important to also consider these factors when evaluating the potential return on your investment.

How to research The Boring Company stock before buying?

- Check financial news sources: Start by researching recent news articles, announcements, and press releases related to The Boring Company. This can give you insights into the company's current projects, partnerships, and overall financial health.

- Review the company's financial reports: Look at the company's quarterly and annual financial reports, which can provide information on its revenue, expenses, profits, and other key financial metrics. You can find these reports on the company's website or through the Securities and Exchange Commission (SEC) website.

- Analyze the company's business model: Understand how The Boring Company generates revenue, who its customers are, and what its competitive advantages are in the market. This can help you assess the company's long-term growth potential.

- Look at analyst reports: Many financial firms and investment banks publish research reports on publicly traded companies, including The Boring Company. These reports often include price targets, investment recommendations, and detailed analysis of the company's performance.

- Monitor social media and investor forums: Follow discussions on social media platforms like Twitter and investor forums like Seeking Alpha to see what other investors are saying about The Boring Company stock. However, be cautious of misinformation and speculation on these platforms.

- Consider speaking with a financial advisor: If you're unsure about how to research and evaluate The Boring Company stock, consider seeking guidance from a financial advisor. They can provide personalized advice based on your investment goals and risk tolerance.