Best Market Cap Filter Tools to Buy in March 2026

A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today

The AutoStory Stock Market Trading Flashcards | 72 Trading Candlestick Flashcards | Financial Literacy Tool

- MASTER TRADING WITH EXPERT-DESIGNED FLASHCARDS FOR ALL SKILL LEVELS!

- COMPACT AND DURABLE-LEARN ANYWHERE, ANYTIME WITH EASE!

- A PERFECT GIFT FOR ASPIRING TRADERS-EDUCATION MEETS FUN!

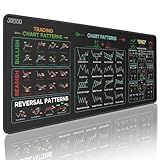

JIKIOU Stock Market Invest Day Trader Trading Mouse Pad Chart Patterns Cheat Sheet,X-Large Computer Mouse Pad/Desk Mat with Stitched Edges 31.5 x 11.8 in

-

UNIQUE DESIGN FOR POSITIVE VIBES: GREEN BACKGROUND SYMBOLIZES LUCK IN TRADING.

-

ESSENTIAL TRADING TOOLS INCLUDED: FEATURES CHARTS AND INDICATORS FOR EASY REFERENCE.

-

SUPERIOR QUALITY & DURABILITY: NON-SLIP BASE AND LONG-LASTING MATERIAL FOR DAILY USE.

Gimly - Trading Chart (Set of 5) Pattern Posters, 350 GSM Candle Chart Poster, Trading Setup Kit for Trader Investor, (Size : 30 x 21 CM, Unframed)

- EYE-CATCHING 12X8 POSTERS FOR STOCK & CRYPTO MARKET ENTHUSIASTS!

- DURABLE 350 GSM PAPER ENSURES LONG-LASTING VISUAL IMPACT.

- GLOSS FINISH ENHANCES DETAIL, MAKING PATTERNS EASY TO READ!

Stock Trader's Almanac 2025 (Almanac Investor Series)

Day Trading Flash Cards - Stock Market Chart & Candlestick Patterns, Instructions to Trade Like a Pro!

-

MASTER TRADING WITH 20 CHART PATTERNS AND 34 CANDLESTICK DESIGNS!

-

PORTABLE FLASH CARDS PERFECT FOR ON-THE-GO LEARNING AND TRADING SKILLS.

-

UPGRADED 2ND EDITION ENHANCES TRADING CONFIDENCE AND DECISION-MAKING!

Candlestick Pattern Cheat Sheet for Trading – 3-Page Durable Cardstock with 190+ Chart Patterns – Includes Candlestick and Traditional Technical Analysis for Stock, Crypto, and Forex Traders

-

UNLOCK 190+ CANDLESTICK PATTERNS TO BOOST YOUR TRADING SUCCESS!

-

MAKE INFORMED DECISIONS WITH PROVEN HISTORICAL PRICE ACTION PATTERNS.

-

DURABLE, PORTABLE DESIGN FOR TRADERS-PERFECT FOR ANY MARKET STRATEGY!

How to Day Trade for a Living: A Beginner’s Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing)

-

WORK FROM ANYWHERE: FLEXIBILITY TO TRADE YOUR WAY!

-

BE YOUR OWN BOSS: TAKE CONTROL OF YOUR FINANCIAL FUTURE!

-

SUCCESS REQUIRES TOOLS & DETERMINATION: ARE YOU READY TO THRIVE?

Bloss Stock Market Mouse Pad, Large Desk Mat for Keyboard and Mouse, Non-Slip Mousepad with Investing Guidance for Beginners(31.5" × 11.8" x 0.12")

-

INSTANT CHART ACCESS: KEEP CHARTS IN VIEW FOR QUICKER TRADING DECISIONS!

-

AFFORDABLE MASTERY: GAIN TRADING SKILLS WITHOUT COSTLY COURSES TODAY!

-

COMFORTABLE AND PRECISE: ERGONOMIC DESIGN ENSURES ACCURACY DURING TRADES.

Stock Market Trend Neon Sign Day Trading Line Chart Neon Light LED Neon Sign for Wall Decor LED Neon Light for Trading Room Bar Man Cave Wall Art Finance Day Trading Accessories Gift

- UNIQUE DESIGN MAKES IT A PERFECT GIFT FOR FRIENDS AND TRADERS!

- VERSATILE DECOR FITS BARS, BEDROOMS, GAME ROOMS, AND MORE!

- ENERGY-EFFICIENT LED LASTS OVER 50,000 HOURS, PLUG AND PLAY!

Filtering stocks by market cap is a common method used by investors to narrow down their investment choices based on the size of the company. Market cap, short for market capitalization, is the total value of a company's outstanding shares of stock. It is calculated by multiplying the current share price by the total number of outstanding shares.

To filter stocks by market cap, investors can set criteria based on different size categories such as large-cap, mid-cap, or small-cap companies. Large-cap companies generally have market caps of $10 billion or more, mid-cap companies have market caps between $2 billion and $10 billion, and small-cap companies have market caps less than $2 billion.

Investors can use various screening tools provided by brokerage firms or financial websites to filter stocks based on their market cap. These tools allow investors to set specific market cap parameters to find stocks that fit within their desired size category.

Filtering stocks by market cap can help investors narrow down their investment choices and focus on companies that align with their risk tolerance, investment goals, and overall investment strategy. It is important to remember that market cap is just one factor to consider when evaluating stocks, and investors should conduct thorough research and analysis before making investment decisions.

What is considered a large-cap stock?

A large-cap stock is a stock of a company with a market capitalization of typically more than $10 billion. These companies are typically well-established and have a stable financial track record. Large-cap stocks are considered to be less volatile than small-cap or mid-cap stocks, and are often seen as a more conservative investment option. Examples of large-cap stocks include companies like Apple, Microsoft, and Amazon.

What is market capitalization and why is it important?

Market capitalization refers to the total value of a company's outstanding shares of stock. It is calculated by multiplying the company's current stock price by the total number of outstanding shares.

Market capitalization is important because it gives investors a sense of the size and scale of a company. Companies with larger market capitalizations are typically seen as more stable and established, while companies with smaller market capitalizations are often seen as riskier investments.

Market capitalization also plays a role in determining the composition of stock market indices, such as the S&P 500 or the Dow Jones Industrial Average. Companies with larger market capitalizations are more likely to be included in these indices, which can impact investment decisions and market performance.

Overall, market capitalization serves as an important indicator of a company's relative size and value in the market, and can be used by investors to make informed decisions about their investment portfolios.

How to filter stocks by market cap on a financial website?

- Go to the stock screening or stock search section on the financial website.

- Look for the option to filter stocks by market capitalization. This option may be labeled as "market cap" or "market capitalization."

- Once you have found the option, you can specify a range of market cap values to filter the stocks. For example, you can filter for stocks with a market cap between $1 billion and $5 billion.

- Click on the apply or search button to see the results of the filtered stocks by market cap.

- You can further refine the search results by adding more filters such as industry sector, earnings growth rate, dividend yield, etc.