Best Stock Options Calculators to Buy in March 2026

Online Investing For Dummies

Sharp 12-Digit Printing Calculator with Extra Large 10-Digit Option, 8.0 LPS Thermal Printer, No Ink Required, Full-Sized Keyboard, Easy Paper Load (ELT3301)

- EXTRA LARGE DISPLAY: EASY READING WITH 50% LARGER PRINT OPTIONS.

- QUICK PAPER CHANGE: TOP-LOADING COMPARTMENT FOR HASSLE-FREE REFILLS.

- FAST, QUIET PRINTING: 8 LINES/SEC THERMAL PRINTING-NO INK NEEDED!

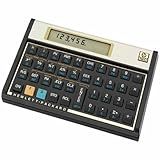

HP 12C Financial Calculator – 120+ Functions: TVM, NPV, IRR, Amortization, Bond Calculations, Programmable Keys – RPN Desktop Calculator for Finance, Accounting & Real Estate – Includes Case + Cloth

- 40+ YEARS TRUSTED BY PROS: INDUSTRY-STANDARD FOR FINANCE SINCE 1981.

- 120+ FINANCIAL FUNCTIONS: PERFORM COMPLEX CALCULATIONS EFFORTLESSLY.

- FAST RPN ENTRY: STREAMLINE WORKFLOWS WITH EFFICIENT DATA INPUT.

Options Calculator Pro

- LIGHTNING-FAST DATA DOWNLOADS FOR INSTANT INSIGHTS!

- ACCURATE ALGORITHMS ENSURE PROFESSIONAL-LEVEL PRECISION.

- USER-FRIENDLY DESIGN WITH FLEXIBLE INPUT AND SIMULTANEOUS VIEWS.

Options Calculator Beginner

- FAST, ACCURATE ALGORITHM BOOSTS TRADING CONFIDENCE AND SUCCESS.

- FLEXIBLE DATA INPUT FOR CUSTOMIZED TRADING STRATEGIES ON-THE-GO.

- VIEW CALL AND PUT OPTIONS SIDE-BY-SIDE FOR QUICK DECISION-MAKING.

Trading Journal: Simple & Easy Stock, Options, Forex, Crypto & Day Trading Log Book: 8x10 Trading Notebook in Positive Green

HP 12C Financial Calculator – 120+ Functions: TVM, NPV, IRR, Amortization, Bond Calculations, Programmable Keys (HP)

- PROVEN RELIABILITY: 40+ YEARS TRUSTED BY FINANCE PROFESSIONALS.

- FAST, ACCURATE CALCULATIONS BOOST PRODUCTIVITY IN HIGH-STAKES SCENARIOS.

- ESSENTIAL TOOL FOR SUCCESS IN REAL ESTATE, BANKING, AND FINANCE.

A stock options calculator can be a valuable tool for investors looking to assess the potential risks and rewards of trading options. To use a stock options calculator effectively, you will need to input various parameters such as the underlying stock price, option strike price, expiration date, and volatility.

By entering this information into the calculator, you can analyze different scenarios and determine the potential profit or loss of a particular options trade. The calculator can also help you evaluate the probability of your option reaching a certain price level by the expiration date.

In addition, using a stock options calculator can help you quantify the potential risk of a trade by calculating metrics such as delta, gamma, and theta. By understanding these risk measures, you can make more informed decisions when trading options and manage your portfolio more effectively.

Overall, using a stock options calculator can provide you with valuable insights into the risks and rewards of trading options, enabling you to make more informed investment decisions. It is important to remember that no calculator can predict the future with certainty, so it is crucial to use the information provided as a guide rather than a definitive answer.

How to calculate the break-even point for a stock option using a calculator?

To calculate the break-even point for a stock option using a calculator, follow these steps:

- Determine the initial cost of the option. This is the amount you paid for the option contract.

- Determine the strike price of the option. This is the price at which you can buy or sell the underlying stock.

- Add the initial cost of the option to the strike price if you have a call option (which gives you the right to buy the stock) or subtract it if you have a put option (which gives you the right to sell the stock). This will give you the break-even point for the option.

- Input these values into your calculator and perform the necessary calculations to determine the break-even point.

For example, if you bought a call option for $2 with a strike price of $50, your break-even point would be $52 ($50 strike price + $2 initial cost). If you bought a put option for $3 with a strike price of $45, your break-even point would be $42 ($45 strike price - $3 initial cost).

How to use historical data in a stock options calculator for risk analysis?

Stock options calculators can be powerful tools for analyzing risk and making informed investment decisions. Historical data can be used in these calculators to provide a more accurate picture of how a stock or option has performed in the past and how it may perform in the future. Here are some ways to use historical data in a stock options calculator for risk analysis:

- Volatility analysis: Historical stock price data can be used to calculate the historical volatility of a stock. This information can then be used in options pricing models to estimate the future volatility of the stock, which can help investors assess the level of risk associated with a particular option.

- Risk-return analysis: Historical data on a stock's returns can be used to calculate various risk metrics, such as the Sharpe ratio, which measures the risk-adjusted return of an investment. By inputting this data into a stock options calculator, investors can evaluate the potential return of an option relative to its risk level.

- Scenario analysis: Historical stock price data can be used to simulate various scenarios using a stock options calculator. For example, investors can input different levels of historical volatility, interest rates, and stock prices to see how these factors could impact the value of an option and assess the associated risks.

- Backtesting strategies: Investors can use historical data to backtest different trading strategies using a stock options calculator. By inputting historical stock prices and options data, investors can evaluate how various strategies would have performed in the past and assess their potential risk and return profile.

Overall, historical data can provide valuable insights for risk analysis in stock options calculators. By using this data effectively, investors can make more informed decisions and better manage their investment risks.

How to use a stock options calculator to track risk management strategies?

To use a stock options calculator to track risk management strategies, follow these steps:

- Input the details of the stock option contract you are considering, including the current stock price, strike price, expiration date, and option type (call or put).

- Use the calculator to calculate the theoretical price of the option based on various factors, such as the stock price, interest rates, and volatility.

- Determine the potential profit and loss scenarios for the option based on different price movements of the underlying stock.

- Use the calculator to analyze the impact of different risk management strategies, such as setting stop-loss orders, hedging with other options, or adjusting position size.

- Compare the potential risk and reward of different strategies to identify the best approach for your trading or investing goals.

- Monitor the performance of your option position over time and make adjustments as needed based on changes in market conditions and your risk tolerance.

Overall, using a stock options calculator can help you make more informed and strategic decisions when trading options by tracking and managing the risks associated with your positions.