Best Fertility Loan Options to Buy in February 2026

Frida Fertility Lubricant, Conception-Friendly Water Based Lube for Family Planning and Pregnancy Support, Sperm and pH Balance Safe, Natural Hydration, Stain Free and Non-Sticky, 1.7 Fl Oz

- PRESERVE SPERM VIABILITY WITH OUR ADVANCED PH-BALANCED LUBRICANT.

- MIMICS NATURAL FLUIDS FOR COMFORTABLE, EFFECTIVE CONCEPTION SUPPORT.

- EFFORTLESS APPLICATION - NO SYRINGES, JUST POP AND PLAY!

Daily Wellness Fertility Blend for Women - Fertility Supplements for Women, Conception Fertility Prenatal Vitamins, Trying to Conceive Progesterone Supplements, Cycle Support Conception Pills - 1 Pack

- BOOST FERTILITY NATURALLY WITH A HERBAL VITAMIN BLEND FOR LASTING HEALTH.

- SUPPORT HORMONE BALANCE AND OVULATION REGULARITY FOR IMPROVED CONCEPTION.

- EASY DAILY REGIMEN WITH 90 VEGGIE CAPSULES FOR YOU AND YOUR PARTNER.

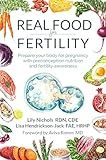

Real Food for Fertility: Prepare your body for pregnancy with preconception nutrition and fertility awareness

One Month Supply Each-FERTILITY BLEND Supplement for MEN (60 Tablets) and FERTILITY BLEND Supplement for WOMEN (90 Tablets).by The Daily Wellness Co.

-

ACHIEVE OPTIMUM FERTILITY NATURALLY, AVOIDING THE PAIN OF IVF.

-

BACKED BY INDEPENDENT STUDIES SHOWING 1/3 SUCCESS IN CONCEPTION.

-

TRUSTED BRAND WITH 20 YEARS OF INNOVATION IN NATURAL HEALTH SOLUTIONS.

Fertility Blend Daily Wellness for Men - Male Fertility Supplements, Vitamin Blend Pills - Male Count Pre-Conception for Him - Fertility Supplements for Men - 60 Capsules, 1 Pack

- BOOST MALE FERTILITY NATURALLY WITH OUR HERBAL VITAMIN BLEND!

- SUPPORTS PRECONCEPTION HEALTH FOR MEN AGED 25 TO 44.

- PERFECT GIFT FOR COUPLES ON THEIR FERTILITY JOURNEY TOGETHER!

If you are in need of a small loan for fertility treatments, you may want to consider researching financial institutions or organizations that specialize in providing funding for medical expenses. Some options to explore include healthcare credit companies, fertility financing programs, personal loans from banks or credit unions, or crowdfunding platforms. Additionally, some fertility clinics may offer payment plans or financial assistance programs to help patients cover the costs of treatment. It's important to thoroughly research and compare your options to find a solution that best fits your needs and financial situation.

How to choose the right lender for a small loan for fertility treatments?

- Research different lenders: Start by researching different lenders that offer small loans for fertility treatments. Look into their reputation, interest rates, terms and conditions, and customer reviews.

- Consider the interest rates: Compare the interest rates offered by different lenders and choose the one that offers the most competitive rates. Remember that even a slight difference in interest rates can make a big impact on the total cost of the loan.

- Check the loan terms: Make sure to carefully review the loan terms and conditions, including the repayment schedule, any fees or penalties, and any other important details. Choose a lender that offers flexible repayment options that suit your financial situation.

- Look for lenders that specialize in fertility treatment loans: Some lenders specialize in providing loans specifically for fertility treatments. These lenders may have more experience in this area and may offer more tailored loan options.

- Consider alternative financing options: In addition to traditional lenders, consider alternative financing options such as medical financing companies or crowdfunding platforms specifically for fertility treatments. These options may offer more flexibility and specialized support for fertility treatment expenses.

- Seek recommendations: Talk to your fertility clinic or healthcare provider for recommendations on reputable lenders for fertility treatment loans. They may have experience working with certain lenders and can provide valuable insights and recommendations.

- Read reviews and testimonials: Before making a decision, read reviews and testimonials from other individuals who have used the lender for fertility treatment loans. This can give you a better idea of the lender's reputation and customer satisfaction.

- Trust your instincts: Ultimately, trust your instincts and choose a lender that you feel comfortable and confident working with. Make sure to ask any questions or address any concerns before finalizing the loan agreement.

What is the minimum credit score required for a small loan for fertility treatments?

The minimum credit score required for a small loan for fertility treatments can vary depending on the lender and the specific loan program. Some lenders may require a minimum credit score of around 620 to 650 in order to qualify for a small loan for fertility treatments. It is recommended to research various lenders and loan programs to determine their specific credit score requirements.

What is the interest rate typically associated with small loans for fertility treatments?

The interest rate for small loans for fertility treatments can vary depending on the lender, the borrower's credit history, and other factors. Generally, interest rates for personal loans used for medical expenses like fertility treatments can range from around 5% to 36%, with the average interest rate falling between 10% and 20%. It is advisable for borrowers to shop around and compare offers from multiple lenders to find the best interest rates and terms for their individual situation.

What is the impact of pre-qualifying for a small loan for fertility treatments?

Pre-qualifying for a small loan for fertility treatments can have a significant impact on individuals or couples seeking fertility assistance. Here are some potential benefits:

- Peace of mind: Knowing that they have been pre-qualified for a loan can give individuals or couples peace of mind, as they will have a clear understanding of how much financial assistance they can access for their fertility treatments.

- Access to immediate funds: Pre-qualifying for a loan can allow individuals or couples to access funds quickly, without having to go through a lengthy application process when they are ready to proceed with their fertility treatments.

- Increased flexibility: Having access to pre-qualified funds can give individuals or couples more flexibility in choosing the type of fertility treatments they want to pursue, without being limited by financial constraints.

- Improved chances of success: Fertility treatments can be costly, and having access to pre-qualified funds can increase the chances of success for individuals or couples undergoing these treatments, as they can afford the necessary medications, procedures, and follow-up care.

- Reduced stress: Financial concerns are a common source of stress for individuals or couples undergoing fertility treatments. Pre-qualifying for a loan can help alleviate some of this stress, allowing them to focus on the emotional and physical aspects of their fertility journey.

Overall, pre-qualifying for a small loan for fertility treatments can provide individuals or couples with the financial support they need to pursue their dream of starting or expanding their family.

How to avoid scams when applying for a small loan for fertility treatments?

- Research the lender: Make sure the lender is reputable and licensed. Check online reviews and ratings to verify their legitimacy.

- Avoid unsolicited offers: Be cautious of any unsolicited offers for loans, especially those that promise guaranteed approval. Legitimate lenders typically do not reach out to potential borrowers unsolicited.

- Verify the terms and conditions: Carefully read and understand the terms and conditions of the loan agreement. Look for any hidden fees or charges that are not disclosed upfront.

- Beware of upfront payment requests: Legitimate lenders do not typically require upfront payments or fees before approving a loan. If a lender asks for payment before providing the loan, it may be a scam.

- Be wary of high-interest rates: While it is common for loans to have interest rates, be cautious of lenders who offer loans with excessively high interest rates. Compare rates from multiple lenders to ensure you are getting a fair deal.

- Check for secure websites: When applying for a loan online, make sure the lender's website is secure. Look for "https" in the URL and a padlock symbol in the address bar.

- Verify contact information: Make sure the lender's contact information is valid and easily accessible. Avoid lenders who only provide a PO box or email address as their contact information.

- Trust your instincts: If something seems too good to be true or if you feel uncomfortable with the lender, trust your gut instincts and walk away. It's better to be safe than sorry.

By following these tips, you can reduce the risk of falling victim to a scam when applying for a small loan for fertility treatments.