Best Personal Loan Options in Virginia to Buy in February 2026

5 Options to Maximize Your VA Home Loan Benefit

Medical Student Loans: A Comprehensive Guide

Landlord Away Your Student Loan Debt

Get a Financial Life: Personal Finance in Your Twenties and Thirties

Personal Finance in Plain English: Definitions. Examples. Uses. (Financial Literacy Guide Series)

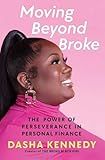

Moving Beyond Broke: The Power of Perseverance in Personal Finance

Wanted: Toddler's Personal Assistant: How Nannying for the 1% Taught Me about the Myths of Equality, Motherhood, and Upward Mobility in America

Knock Knock Personal Library Kit Classic Edition Personal Library Kit

Virginia, officially known as the Commonwealth of Virginia, is a state located in the southeastern part of the United States. It is bordered by Maryland and Washington D.C. to the north and east, the Atlantic Ocean to the east, North Carolina and Tennessee to the south, and Kentucky and West Virginia to the west.

Virginia has a rich history, being one of the original 13 colonies and playing a significant role during the American Revolution and Civil War. It is known as the "Mother of Presidents" as eight U.S. presidents were born in Virginia, including George Washington and Thomas Jefferson.

The state is characterized by diverse geography, with the Blue Ridge Mountains in the west, the Chesapeake Bay in the east, and the coastal plain in between. Virginia has a moderate climate, with hot, humid summers and mild winters.

Major cities in Virginia include the capital city, Richmond, which is known for its historical significance and museums. Other notable cities include Virginia Beach, the largest city in the state and a popular tourist destination, Alexandria, known for its charming Old Town, and Norfolk, an important naval base.

Virginia boasts a strong economy, with sectors such as technology, defense, and government playing significant roles. The state is home to many prestigious universities and colleges, including the College of William & Mary, the University of Virginia, and Virginia Tech.

Residents and visitors can enjoy various outdoor activities such as hiking, biking, and boating due to the state's diverse landscape. Virginia is also known for its vibrant arts and culture scene, with numerous theaters, museums, and music festivals throughout the state.

In terms of cuisine, Virginia is famous for its seafood, particularly Chesapeake Bay blue crabs and oysters. The state is also known for its production of wine and has several vineyards and wineries.

Overall, Virginia offers a mix of historical significance, natural beauty, and modern amenities, making it an attractive destination for residents and tourists alike.

What is the typical interest rate range for personal loans in Virginia?

The typical interest rate range for personal loans in Virginia can vary depending on several factors, such as the borrower's credit history, income, and the lender's policies. Generally, interest rates for personal loans in Virginia can range from around 6% to 36%. However, it's important to note that these rates are estimates and can vary depending on individual circumstances. It is advisable to shop around and compare rates from multiple lenders to find the best rate available.

How long does it typically take to process a personal loan application in Virginia?

The processing time for a personal loan application in Virginia can vary depending on several factors. Typically, it takes around one to two weeks to process a personal loan application. However, this timeline can vary based on the specific lender, the completeness of the application, the required documentation, and the applicant's creditworthiness. Some lenders may offer faster processing times, while others may take longer, so it is advisable to inquire with the chosen lender about their specific processing time.

Can I apply for a personal loan with a co-signer or guarantor in Virginia?

Yes, it is possible to apply for a personal loan with a co-signer or guarantor in Virginia. Having a co-signer or guarantor can increase your chances of getting approved for a loan, especially if you have a limited credit history or poor credit score. The co-signer or guarantor essentially acts as a backup in case you fail to repay the loan. However, keep in mind that the co-signer or guarantor will also be legally responsible for repaying the loan if you default, so it's important to have a clear understanding of the terms and responsibilities before proceeding with a co-signer or guarantor. It's recommended to contact different lenders or financial institutions to inquire about their specific requirements and whether they allow co-signers or guarantors for personal loans in Virginia.

What are the key differences between secured and unsecured personal loans in Virginia?

The key differences between secured and unsecured personal loans in Virginia are:

- Collateral Requirement: Secured personal loans require collateral, such as a car, home, or other valuable asset, which the lender can claim if the borrower defaults on the loan. Unsecured personal loans do not require collateral.

- Risk for the Borrower: With secured loans, the borrower's collateral is at risk of repossession if they fail to repay the loan, while unsecured loans do not put any specific assets at risk. However, non-payment of both types of loans can negatively impact the borrower's credit score and financial history.

- Interest Rates: Generally, secured loans tend to have lower interest rates compared to unsecured loans. Since secured loans are less risky for the lender, they may offer more favorable interest rates.

- Loan Amount: Secured loans often allow borrowers to access larger loan amounts as they provide a form of security for the lender. Unsecured loans typically have lower borrowing limits since there is no collateral to cushion the risk.

- Repayment Terms: Secured loans usually have longer repayment terms, allowing borrowers to spread out their payments over a more extended period. Unsecured loans often have shorter repayment terms, requiring borrowers to repay the loan in a shorter duration.

- Eligibility Criteria: Secured loans might have more flexible eligibility criteria as the collateral lessens the risk for the lender. Unsecured loans may have stricter eligibility requirements, including a higher credit score and stable income.

It's important to note that the specific terms and conditions of personal loans in Virginia may vary among lenders. It's advisable to research and compare offerings from different lenders to find the best loan that suits individual needs.