Most people keep their bills and bank statements for around 2 years. Even they choose to keep the insurance documents as long as they have their validity. Tax-related paperwork including P45s and payslips should be kept for at least 22 months as suggested by the HMRC. The recommendation is to keep the paperwork totally for a span of 22 months from the end of the tax year.

The present scenario

About two-thirds of the general population use digital banking with the help of a personal computer or a phone. Still more than half continue keeping their bank and credit card statements in the form of paper works.

Some people get satisfaction in seeing the actual piece of paper that is signed. If you have a paper filing system or access to the records online, you will still require old statements for several reasons.

TAKEAWAYS

People should keep the bank copies in the form of hard copy or electronic form for at least one year. It makes them easy to access. Later on, they can throw it away.

Document proof related to charitable donations should be also kept for around 3 years.

You should also review the last statement at least once a month for checking the errors or fraud.

How Long Should You Actually Keep the Statements?

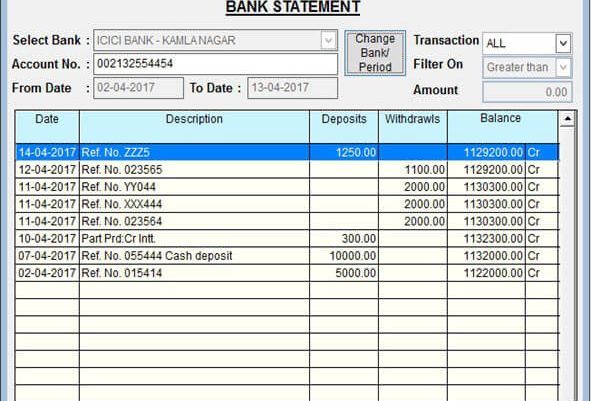

If you don’t opt for the monthly bank statements in terms of mail, then you should at least keep them in the form of pepper documents for one year. In case the account is online, you should review the deposit and withdrawal on a monthly basis.

After one year, you can discard the paper. However, the documents related to the tax deduction should be kept for 3 years.

Why Keep the Statements?

You should always have access to the record of the bill payments, recent purchase, and payroll deposit become necessary in case of disputes.

The bank account activity paperwork also becomes evidence of Identity theft and debit card fraud. The statements will always provide verification regarding the illicit activities.

The tax purpose also considers the paper documents as an important entity. If you have bank account statements including a large process of payments, it’s worth keeping the needed hardcopy.

Sometimes you might need proof of purchase to file insurance claims or using a variant.

The ATM receipts also give an idea about the account record. You should keep the deposit and withdrawal slip for some time. But, throw them once the transactions become verified with the monthly statement.

Some banks maintain monthly customer statements for at least five years. They are accessible through online banking apps and sites. Printable formats including the summaries of transaction information help in download sessions.

Keeping hard copy bank statements in a fireproof safe and secured environment will definitely beat importance.

Conclusion

Sometimes it might seem that keeping records forever will fetch better outputs than setting aside. But that’s not true. Most of the bank statements require only a certain time to be kept as proof.

In the case of house and car insurance policies, you can choose to shred away old ones once you received the new policies.

Again, in the case of mortgage statements and home improvement, you can shred away the documents once you sell the house.

The conditions for keeping the paper documents are varied upon the type of bank statement. All you need to do use to keep track of their importance and validity.