Best Business Loan Options to Buy in March 2026

The Insider’s Guide to Business Credit Using an EIN Only: Get Tradelines, Credit Cards, and Loans for Your Business with No Personal Guarantee

Small Business Loans Made Simple: Revealing Insider Secrets and Strategies For Established Businesses

Business Funding For Dummies

Approved: How to Get Your Business Loan Funded Faster, Cheaper & With Less Stress

Business Loans: Complete Guide On How To Choose & Get The Right Small Business Loan: Business Loan Book

The Business Loan Broker's Blueprint: Turn Every Conversation into Cash Flow and Build a Six-Figure Loan Brokerage

The SBA Loan Book: The Complete Guide to Getting Financial Help Through the Small Business Administration

How To Get Money for Small Business Start Up: How to Get Massive Money from Crowdfunding, Government Grants and Government Loans

Loan Approved!: The Essential Guide to Getting the Best Small Business Loan

Mastering Business Lending Sales: Proven Scripts and Strategies for Success

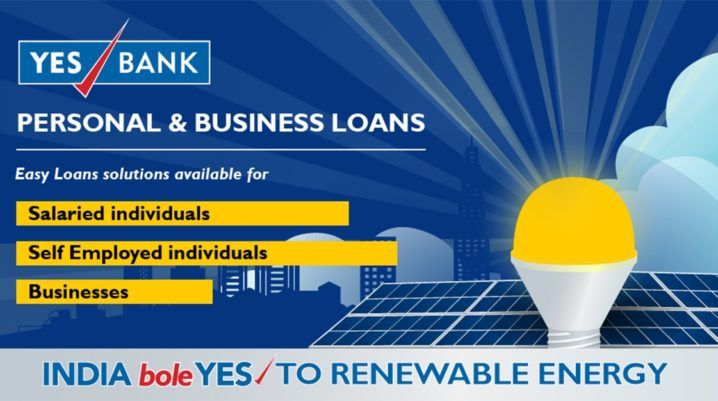

YES Bank is one of the major banking institutions in the private sector. This serves as the benefactor for businesses that need monetary assets for business expansion. YES Bank offers various Business loans to self-employed people and businessmen to provide them with financial assistance to start a new business or to grow an existing company. Here is the guide on how to apply for the Yes Bank Business Loan.

The loan amount available is from Rs. 2 lakhs to 4 crores. The bank’s loans are dedicated to security. The disbursement of the loan depends on the borrower’s credibility and the tenure as well. Lenders with a good credit history and a secure financial position can be granted with a high loan amount. The disbursement amount depends, though, on the scheme that the consumer prefers.

Read More – Yes Bank Home Loan –Know Features, Documents, Eligibility, Apply Process

Why Prefer YES Bank Business Loan?

For start-ups and established companies, YES Bank offers business loans at an affordable rate. With YES Bank you can quickly execute your business idea because it makes money accessible in no time. Also, the YES Bank business loan is the best option for you for many other reasons like

- Clear verification of the loan

- A loan service fee of only up to 3 percent

- Please enjoy your business loan without any protection

- No additional costs

- Receive cash in just 2 days

- Extend the repayment period up to 60 months

- Order your loans in just a few clicks

- Receive a high quantum loan up to 50 lac

Business Loan Schemes:

Yes Sambhav Business Loan: Loan eligible for Rs. 20,00,000 minimum up to Rs. 1,00,00,000 limit

Yes Samriddhi Business Loan: Flexible loan sanctions are available up to Rs. 4,00,00,000 and depends on the annual turnover

Yes Suyog Business Loan: Users can get a maximum loan amount of Rs. 2,00,00,000 having good CIBIL score

Interest Rates:

The interest rate on a business loan depends on several considerations, such as loan amount, tenor and client existence. When a customer has qualified for the loan the effective cost shall be calculated by the bank.

Eligibility Required to apply for Yes Bank Business Loan:

A loan may be made available to all SMEs engaged in manufacturing, trade, and services. There is no provision for the following business units under any loan types

- Real estate investments

- Business finance firms

- Seasonal company trading

- A company with negative list according to Yes Bank loan policy

Read More – How to Register For Central Bank Of India Netbanking?

Key Documents required to apply for YES Bank Business Loan:

- Applicants should fill MSME Application Form.

- Current three years Annual Report comprising 2 years Audited Declarations and all plans

- Two years of revenue prediction

- ITR returns together with the applicant/co-applicant/guarantor income estimate for at least the last 2 years

- Current financial year sales tax/VAT returns

- CC/OD/Current Account Statement for the last 6 months

- Latest 6 months Repayment Track Statement

- Vintage proof like Shop & Pollution Certificate and so forth

- Applicants KYC documents

- Housing/Property Documents shown as Security

- Self Certified Net worth statement of the Applicant

- Major company’s latest Audited Financials

- Order in hand and, if necessary, appropriate agreement