DollarOverflow

-

It was previously supposed to be April 15, 2020, but the sudden outbreak of Covid-19 has forced the government to add some changes in the due dates of federal taxes and other deadlines. IRS has provided relief for the taxpayers just by extending the deadline of federal tax payment by 90 days. This rescheduling has hopefully have helped the num...

It was previously supposed to be April 15, 2020, but the sudden outbreak of Covid-19 has forced the government to add some changes in the due dates of federal taxes and other deadlines. IRS has provided relief for the taxpayers just by extending the deadline of federal tax payment by 90 days. This rescheduling has hopefully have helped the num...

-

9 min readThe stock market in the Philippines is known as the Philippine Stock Exchange (PSE). It is the only stock exchange in the country and has been in operation since 1927. The PSE is regulated by the Securities and Exchange Commission (SEC) of the Philippines.The PSE is an organized marketplace where investors can buy and sell shares of publicly traded companies.

9 min readThe stock market in the Philippines is known as the Philippine Stock Exchange (PSE). It is the only stock exchange in the country and has been in operation since 1927. The PSE is regulated by the Securities and Exchange Commission (SEC) of the Philippines.The PSE is an organized marketplace where investors can buy and sell shares of publicly traded companies.

-

Whenever someone thinks about making investments, stock market is something that they will come across. Stock market is undoubtedly one of the best options to invest your money and make a profit out of it. Even at the same time stock market is full of risk. However, if you have never invested a single rupee in stock market and you are planning to invest. Then you must be having this question how to invest in stock market in India? Investing in the stock market is not a tough job to do, to be ...

Whenever someone thinks about making investments, stock market is something that they will come across. Stock market is undoubtedly one of the best options to invest your money and make a profit out of it. Even at the same time stock market is full of risk. However, if you have never invested a single rupee in stock market and you are planning to invest. Then you must be having this question how to invest in stock market in India? Investing in the stock market is not a tough job to do, to be ...

-

Are you retired and looking for some best pension plans? If yes, proceed further with this article to know more. In general, retirement is a must for every human being in this world. It is the period where one can able to take complete rest after working hard for so many years. But without money or earning one could not live a comfortable life after retirement. At that time, here come the best pension plans in India for you. Just make use of your most suitable plans and live your retired life p...

Are you retired and looking for some best pension plans? If yes, proceed further with this article to know more. In general, retirement is a must for every human being in this world. It is the period where one can able to take complete rest after working hard for so many years. But without money or earning one could not live a comfortable life after retirement. At that time, here come the best pension plans in India for you. Just make use of your most suitable plans and live your retired life p...

-

Stansberry Research is a free, membership-based distributor of budgetary research, serving singular financial specialists, enlisted venture counselors, flexible investments, common assets, and speculation banks. The most significant way SAM utilizes Stansberry Research is by beginning with its unmistakable venture theory. Any individual who has perused Stansberry Research’s productions realizes that esteem i.e., contributing to an edge of security, and when the chances are well uneven is at t...

Stansberry Research is a free, membership-based distributor of budgetary research, serving singular financial specialists, enlisted venture counselors, flexible investments, common assets, and speculation banks. The most significant way SAM utilizes Stansberry Research is by beginning with its unmistakable venture theory. Any individual who has perused Stansberry Research’s productions realizes that esteem i.e., contributing to an edge of security, and when the chances are well uneven is at t...

-

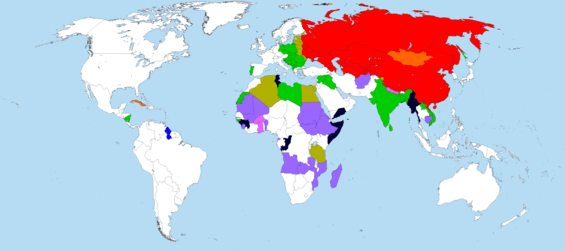

The idea of socialist countries financial system was propounded by German expert Karl Marx in their job the socialist policy; available in 1848. In the collective financial system, the substance means of manufacture i.e. factory, assets, mine, and so on. Are owned and characterized by the State. All associate of the society is allowed to get advantages from entertain designed making based on the same rights and equivalent chance. Image courtesy: https://en.wikipedia.org/wiki/List_of_socialist_...

The idea of socialist countries financial system was propounded by German expert Karl Marx in their job the socialist policy; available in 1848. In the collective financial system, the substance means of manufacture i.e. factory, assets, mine, and so on. Are owned and characterized by the State. All associate of the society is allowed to get advantages from entertain designed making based on the same rights and equivalent chance. Image courtesy: https://en.wikipedia.org/wiki/List_of_socialist_...

-

The motor insurance is the must one for the owners of the vehicle to get the right compensation amount. The vehicle compensation will give you a good time to solve the sudden expense for your vehicle. So if you are, the person still did not register any insurance, and then do it first. You will find plenty of plans for the vehicle’s insurance, and these policies will give you good satisfaction to get the premium amount. The insurance policies will give complete benefits to the people. The fol...

The motor insurance is the must one for the owners of the vehicle to get the right compensation amount. The vehicle compensation will give you a good time to solve the sudden expense for your vehicle. So if you are, the person still did not register any insurance, and then do it first. You will find plenty of plans for the vehicle’s insurance, and these policies will give you good satisfaction to get the premium amount. The insurance policies will give complete benefits to the people. The fol...

-

If you want to have enough money for the future, you need to start saving now. But it’s not always enough to skip fancy vacations. To build wealth, you have to invest in yourself and work your way up to boost your income. Invest in Your Education and Yourself By investing in your education, you might be able to make more money. If you’ve never gone to college, that might mean getting your degree. If you already have your associate’s or bachelor’s, you might want to get an MBA. There is...

If you want to have enough money for the future, you need to start saving now. But it’s not always enough to skip fancy vacations. To build wealth, you have to invest in yourself and work your way up to boost your income. Invest in Your Education and Yourself By investing in your education, you might be able to make more money. If you’ve never gone to college, that might mean getting your degree. If you already have your associate’s or bachelor’s, you might want to get an MBA. There is...

-

It's never a bad idea to stay up to date on new technology, especially when it has specific financial implications. Take bitcoin, for example. The digital currency started out as a quirk, but now it's a mainstay in discussions about global finance. ATMs deal in them, and even billionaires have invested in the technology.

It's never a bad idea to stay up to date on new technology, especially when it has specific financial implications. Take bitcoin, for example. The digital currency started out as a quirk, but now it's a mainstay in discussions about global finance. ATMs deal in them, and even billionaires have invested in the technology.

-

If you ever thought of making money online. Then you already know that working as a freelancer is one of the top ways to earn online. Nowadays there is various kind of freelancing jobs that one can do. However, when it comes to getting freelance jobs, Fiverr is one of the top websites. However, in case if you are looking for some of the sites like Fiverr which are equally good. Then you should stick with this page. Freelancing websites are beneficial for freelancers and clients. And there are q...

If you ever thought of making money online. Then you already know that working as a freelancer is one of the top ways to earn online. Nowadays there is various kind of freelancing jobs that one can do. However, when it comes to getting freelance jobs, Fiverr is one of the top websites. However, in case if you are looking for some of the sites like Fiverr which are equally good. Then you should stick with this page. Freelancing websites are beneficial for freelancers and clients. And there are q...

-

The question that I get asked a lot is “How to become a freelance writer?”. Since I have been in this field quite some time now and made quite a lot of bucks which helped me to make my life quite easier. So I thought of answering the question by writing a guide on it. But before I go ahead and talk about the guide let me clear one thing: “You need to be extremely good at English writing.” Well, this is the common myth that many people have in their mind. But actually, you can write well...

The question that I get asked a lot is “How to become a freelance writer?”. Since I have been in this field quite some time now and made quite a lot of bucks which helped me to make my life quite easier. So I thought of answering the question by writing a guide on it. But before I go ahead and talk about the guide let me clear one thing: “You need to be extremely good at English writing.” Well, this is the common myth that many people have in their mind. But actually, you can write well...