Posts - Page 211 (page 211)

-

CBI net banking is an e-internet facility provided by the central bank of India which is among the most renowned bank of its region. Its primary purpose is to minimize rush in banking services. Meaning that this net banking facility allows you to make inquiries and perform necessary banking activities from your home. Without any further delay, let us see how we can register for CBI net banking and start with these amazing facilities. Central Bank Of India (CBI) Netbanking Central Bank Of Ind...

CBI net banking is an e-internet facility provided by the central bank of India which is among the most renowned bank of its region. Its primary purpose is to minimize rush in banking services. Meaning that this net banking facility allows you to make inquiries and perform necessary banking activities from your home. Without any further delay, let us see how we can register for CBI net banking and start with these amazing facilities. Central Bank Of India (CBI) Netbanking Central Bank Of Ind...

-

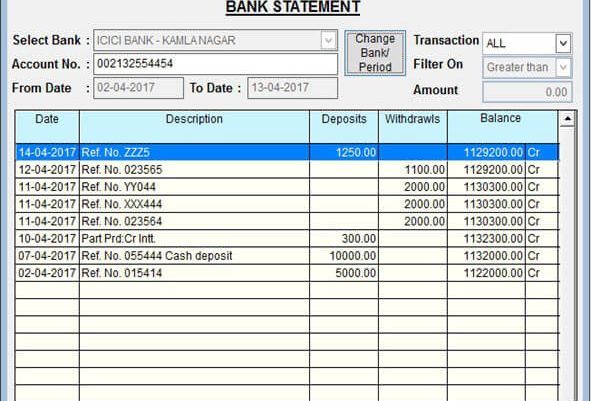

Most people keep their bills and bank statements for around 2 years. Even they choose to keep the insurance documents as long as they have their validity. Tax-related paperwork including P45s and payslips should be kept for at least 22 months as suggested by the HMRC. The recommendation is to keep the paperwork totally for a span of 22 months from the end of the tax year. The present scenario About two-thirds of the general population use digital banking with the help of a personal computer o...

Most people keep their bills and bank statements for around 2 years. Even they choose to keep the insurance documents as long as they have their validity. Tax-related paperwork including P45s and payslips should be kept for at least 22 months as suggested by the HMRC. The recommendation is to keep the paperwork totally for a span of 22 months from the end of the tax year. The present scenario About two-thirds of the general population use digital banking with the help of a personal computer o...